Insurance Accounting Luxembourg

Discount rates 47 22. According to the 2017 OECD Publication entitled Accrual Practices and Reform Experiences in OECD Countries Luxembourg has an ongoing reform process to move to accrual accounting over the medium term though progress has been limited.

An Insurance Company Luxembourg For Finance

An Insurance Company Luxembourg For Finance

The law for Insurance Premium Tax is contained within Acts laid down by the Ministry of Finance.

Insurance accounting luxembourg. It is not just the population that is multilingual. Luxembourg accounting principles are required for separate and consolidated financial statements. Consolidation applies to a set of companies with separate legal personalities but depending on a common decision-making centre the parent company.

In addition the amended Regulation 1503 of 7 December 2015. In Luxembourg the SAF-T equivalent is referred to as FAIA Fichier dAudit Informatis. Consolidated accounts provide an overview of the financial health of a group of companies.

Luxembourgs unique pool of multilingual highly skilled talent provides the key to unlock Europes huge and diverse single market. 12172018 T he International Accounting Standard Board IASB or Board issued the new Insurance Accounting Standard IFRS 17 Insurance Contracts the Standard on 18 May 2017. Offered by the 22 training providers which are members of lifelong-learninglu the portal for lifelong learning.

Handbook for the preparation of annual accounts under Luxembourg accounting framework 3 Introduction The main legal reference in this publication is the law of 19 December 2002 governing the register of commerce and companies and the accounting and annual accounts of undertakings hereafter the Accounting Law or the Law. The Standard will have to be applied for reporting periods starting on or after 1 January 2021. No premium tax on life insurance premium and reinsurance premiums.

Even with two more years to prepare many insurers still have much. Insurance Management Accounting The Globe application AON Insurance Managers has developed throughout the years Globe application which is a robust and comprehensive piece of captive management system designed specifically for Aon Insurance. Methods used and judgements applied in determining the IFRS 17 transition amounts 43 223.

Christophe Hillion - Transfer Pricing Partner Tel. Captive insurance companies Like any Luxembourg commercial company reinsurance companies are liable to pay corporate income tax CIT at a rate of 2184 and a municipal business tax MBT at a rate of 675 in Luxembourg City overall tax rate. Consolidation is the process.

Basis of Luxembourg IPT Calculation The basis for the IPT calculation is the total amount of the premium payable by the insured which includes all costs. De lAdministration de lEnregistrement des. Significant judgements and estimates in applying IFRS 17 39 221.

Luxembourg insurance and reinsurance undertakings professionals of the insurance sector and insurance and reinsurance intermediaries are subject to the Law of 7 December 2015 on the insurance sector as amended. Summary of significant accounting policies for insurance contracts 22 22. Credit institutions insurance and re-insurance companies can choose between IFRSs as adopted by the EU and Luxembourg accounting principles both in separate and consolidated financial statements.

The annual accounting and financial reporting updates for the banking and securities investment management and real estate sectors are available on US GAAP Plus Deloittes Web site for accounting and financial reporting news. Insurance operations 22 21. Estimates and assumptions 46 2231.

6212016 The Luxembourg government is currently using a modified cash accounting system IFAC CIPFA 2018. The countrys multilingual population has native fluency in French and German. Frederic Wersand - VAT Partner Tel.

Law of 12 July 2013 on insurance services amending the Law of 6 December 1991 on insurance services as amended. GDR of 1 August 2014 modifying the GDR of 23 January 2003 executing the Law of 19 December 2002 on the register of commerce and companies and the accounting and annual accounts of undertakings related to documents filing for AIFs. Trainings in Banking and insurance in Luxembourg lifelong-learninglu the reference web site in the training domain in Luxemburg.

This standard will represent the most significant change to European insurance accounting. A n obligation to provide a Standard Audit File for Tax SAF-T containing reliable accounting data has been implemented by the VAT authorities. Entities in the insurance sector.

First published in May 2017 it has since been amended in eight key areas and its effective date has been deferred to 1 January 2023. Luxembourg is also considered one of the most proficient English-speaking nations in the world ranking 11 th globally. Select your preferred training domains View the 566 training courses in Banking and insurance.

The new insurance contracts standard IFRS 17 aims to increase transparency and to reduce diversity in the accounting for insurance contracts. Graud de Borman - Corporate tax Partner leading the Luxembourg insurance practice Tel.

Https Buildersre Lu Wp Content Uploads 2018 05 2018 Sfcr Report Bih Group Pdf

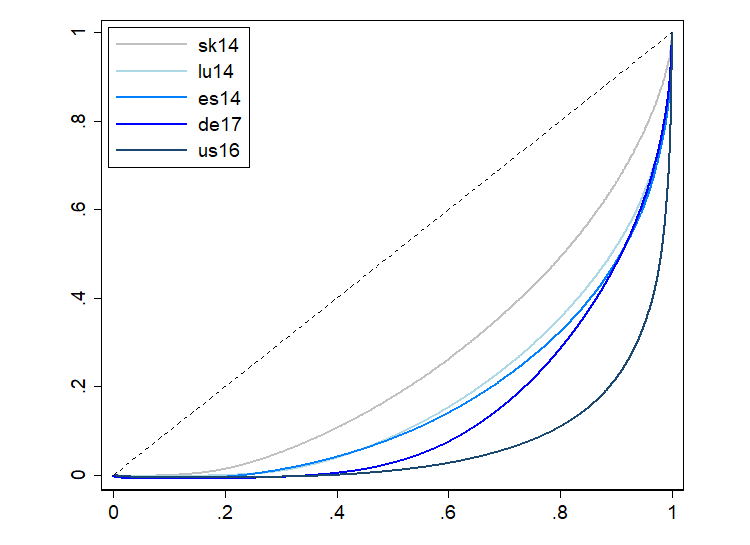

Lis Cross National Data Center In Luxembourg

Lis Cross National Data Center In Luxembourg

Insurance Accounting And Billing Services Outsource2india

Insurance Accounting And Billing Services Outsource2india

Insurance Accounting Insights Deloitte Insurance Contracts Ifrs

Insurance Accounting Insights Deloitte Insurance Contracts Ifrs

Luxembourg Tax Guide Analie Tax Accounting

Luxembourg Tax Guide Analie Tax Accounting

Luxembourg Cfos Earning On Average 140 000 Delano Luxembourg In English

Luxembourg Tax Guide Analie Tax Accounting

Luxembourg Tax Guide Analie Tax Accounting

Insurance Accounting Insights Deloitte Insurance Contracts Ifrs

Insurance Accounting Insights Deloitte Insurance Contracts Ifrs

Fund Services In Luxembourg Tmf Group

Fund Services In Luxembourg Tmf Group

Https Www Sompo Intl Com Wp Content Uploads Siie Sfcr 2019 Final Pdf

Best Paying Jobs In Luxembourg 2021

Reserved Alternative Investment Fund Raif Services Tmf Group

Reserved Alternative Investment Fund Raif Services Tmf Group

Master In Accounting And Audit Luxembourg City Luxembourg 2021

Master In Accounting And Audit Luxembourg City Luxembourg 2021

Post a Comment for "Insurance Accounting Luxembourg"