Insurance Reimbursement Quickbooks

Make a Deposit with two lines. Next step is that you will have to figure out the refund due each covered employee as a percentage of total and then make a payment to the employee to pass on the premium refund.

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Medical Services

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Medical Services

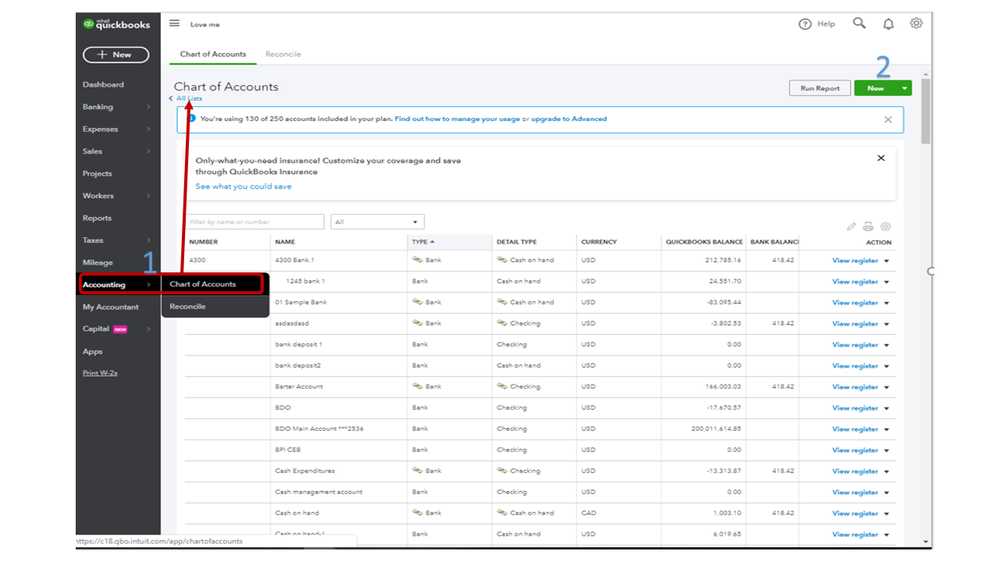

Open the QuickBooks company file.

Insurance reimbursement quickbooks. Premiums paid pre-tax through a spouses employer for a group plan must be reimbursed on a taxable basis- you can read more about that here. 11202020 Select the Reimbursement checkbox. Debit Loss on Insurance Settlement.

I submitted an insurance claim and this month january 2018 i received a check for 2890 2390 total loss less 500 deductible. Click on the box next to Health insurance then click Next. 6132019 QuickBooks Online automatically creates one Accounts Payable account for you.

1182017 How to Enter Shareholders Insurance Reimbursement In Quickbooks - YouTube. Reimbursement for business use of vehicles to an employee of the business. Under the Account column select the Other Income account.

QuickBooks also calculates the employer share of the premiums and records the insurance expense and a payroll liability for the employer share. It will ease your analytical pain. 4272018 I want to help you record the insurance settlement from your insurance provider.

That may be why the refund. If this is the case record the entries as. Youll need to learn QuickBooks approach to setting up employee benefits by using the Payroll Setup wizard.

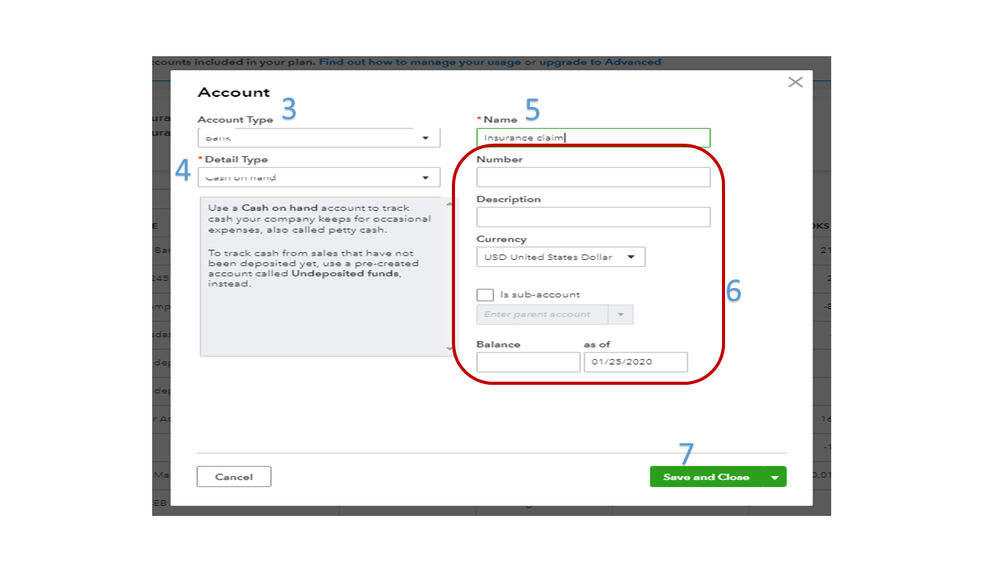

In the Add funds to this deposit section fill out the following fields. Repairs to a roof do not impact on the fixed asset at all a roof replacement does and is a new fixed asset account. For the Account select the expense account you used to pay the insurance.

In 2018 Not exactly sure how you use QuickBooks. Sometimes the insurance company will pay you less than the amount you paid. 7182013 Click on Employee Benefits Insurance Benefits in the menu that appears.

Easiest way to record insurance payments in QuickBooks. Then click the Add New button to open this window. Return to previous page.

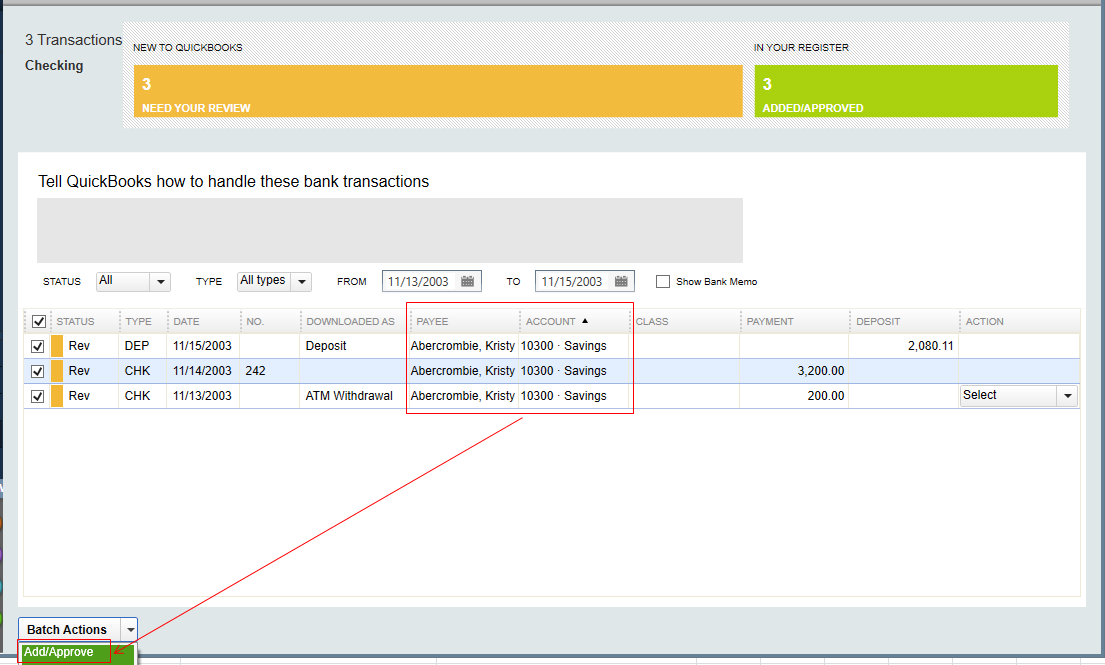

2152011 Your insurance company cash advances andor reimbursements will following along the same lines. In the window that opens click the button next. 5212015 If there is no existing credit open in QuickBooks to which to apply the Vendors refund check then here are the steps you want to take.

Insurance Proceed on damaged property. Quickbooks proadvisor mod 1 point 4 years ago. 1252020 Select Bank deposit.

How to Enter Shareholders Insurance Reimbursement in Quickbooks. Click on the company you will be working on in the main QuickBooks menu. You need to appropriate 289000 as the reimbursement and appropriate 500 for improvement and expense.

In the menu bar click Banking. I have 2 roofs. Read the new rules for S-Corps and health insurance deductions in the instructions for a Form 1120S see Tips.

In the Received From drop-down select the vendor who gave you the refund. Of course that will then CR cash and DB the same insurance expense GL account. To record the settlement in QuickBooks Online you just need to enter a bank deposit.

How to Enter Shareholders Insurance Reimbursement in. 1312019 In the Account drop-down select the account where you got the refund. This is to ensure the transaction is properly categorized.

492011 Loan 20000. Insurance proceeds 20000 loan payoff 10000. And assist with claim filing and claim audits.

Taxable reimbursements qsehra only While most reimbursements through QSEHRA are tax-free there is one type of allowable reimbursement that must be taxed. 12112018 I would book the insurance payment as income split between both properties and I would create an insurance income account for that purpose. Most businesses need only one.

922010 Choose the customer you are invoicing for reimbursable expenses and click the Create Invoice button. 492011 Home quickbooks how to book insurance proceeds in quickbooks. C Set up General Ledger accounts to capture all of these types of spending and reimbursement related to these two types of losses.

If you repair a roof then that is an expense for that property obviously. When you create a regularly scheduled paycheck or an unscheduled check for the employee the Reimbursement field appears in the compensation section of the Enter Employee Pay Details page. On the Class section choose the class the insurance claim will be linked.

Capital Improvements for 247227. Insurance is an account that usually requires an adjusting entry at the end of the time period. Use Insurance payable to keep track of insurance amounts due.

Button on the top menu bar. This usually happens when net book value of the property book value minus accumulated depreciation is more than the amount reimbursed. Step 1 - Record a Deposit for the Vendors Refund.

In this case youd credit 50000 to the fixed asset account and debit 25000 to the depreciation account and 20000 to the loan account to clear out those balances and also debit 10000 to cash. Make sure that the QuickBooks file considers this company as an S-Corp. Create paychecks using the newly created Reimbursement pay type including the Reimbursement amount.

QuickBooks will display the Create Invoices screen for that customer pre-filled with the Memo and amount recorded with the original vendor bill. On the Bank Deposit page go to the Add funds to this deposit section to input the entry. But a simple way would be.

QuickBooks is designed to deduct the employee share of premiums from each paycheck and create a payroll liability to the insurer. The insurance company probably explained same in a cover letter. Click on the Company.

Use Quickbooks To Track Accounts Payable Accounts Payable Quickbooks Accounting

Use Quickbooks To Track Accounts Payable Accounts Payable Quickbooks Accounting

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

Quickbooks File Doctor By Quickbooks Technical Support Phone Number Quickbooks Supportive Phone Numbers

Quickbooks File Doctor By Quickbooks Technical Support Phone Number Quickbooks Supportive Phone Numbers

How To Create A Simple Budget Meredith Rines Budget Spreadsheet Budget Template Budgeting

How To Create A Simple Budget Meredith Rines Budget Spreadsheet Budget Template Budgeting

Class Tracking In Quickbooks For Law Firms Instructions Quickbooks Pro Class List

Class Tracking In Quickbooks For Law Firms Instructions Quickbooks Pro Class List

Ilustrasi Mudah Untuk Pengurusan Harta Inshaallah Dapat Membantu Semua Mohdeizuwar Insurance Marketing Insurance Financial Management

Ilustrasi Mudah Untuk Pengurusan Harta Inshaallah Dapat Membantu Semua Mohdeizuwar Insurance Marketing Insurance Financial Management

Cpa Worldwide Tax Service Pc Just Another Wordpress Site Chandler Az Cpa Worldwide Tax Firm Chinese Cpa Page Tax Services Quickbooks Income Tax Return

Cpa Worldwide Tax Service Pc Just Another Wordpress Site Chandler Az Cpa Worldwide Tax Firm Chinese Cpa Page Tax Services Quickbooks Income Tax Return

How To Record An Owner S Expense Reimbursement In Online Quickbooks

How To Record An Owner S Expense Reimbursement In Online Quickbooks

Full Quickbooks Course Part 2 Of 3 Set Up Your Company Youtube Quickbooks How To Use Quickbooks Learning

Full Quickbooks Course Part 2 Of 3 Set Up Your Company Youtube Quickbooks How To Use Quickbooks Learning

Quickbooks Enterprise Support Quickbooks Quickbooks Online Success Business

Quickbooks Enterprise Support Quickbooks Quickbooks Online Success Business

Quickbooks Technical Support Phone Number Is Available 24 7 To Get On The Spot Help And Hold Your Accounting Related Pr Quickbooks Phone Numbers Technical Help

Quickbooks Technical Support Phone Number Is Available 24 7 To Get On The Spot Help And Hold Your Accounting Related Pr Quickbooks Phone Numbers Technical Help

Post a Comment for "Insurance Reimbursement Quickbooks"