Is Insurance 1099 Reportable

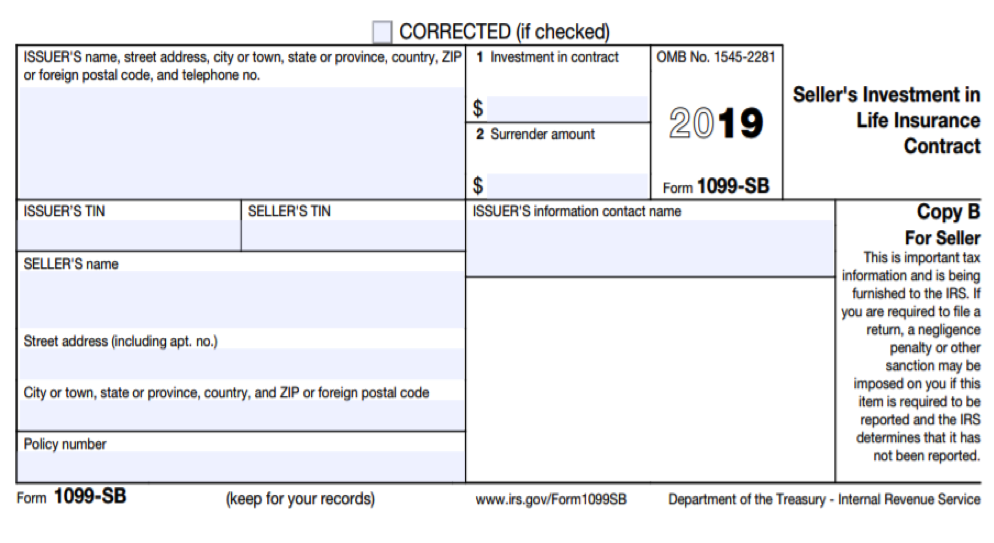

312021 Insurance companies are almost without exception corporations and as such are exempted from IRS 1099-MISC filing requirements except in certain cases unrelated to insurance companies. See the Instructions for Form 1009-LS for complete filing requirements.

What Is A 1099 Misc Form W9manager

What Is A 1099 Misc Form W9manager

The simple answer is there is no such thing as a 1099 employee.

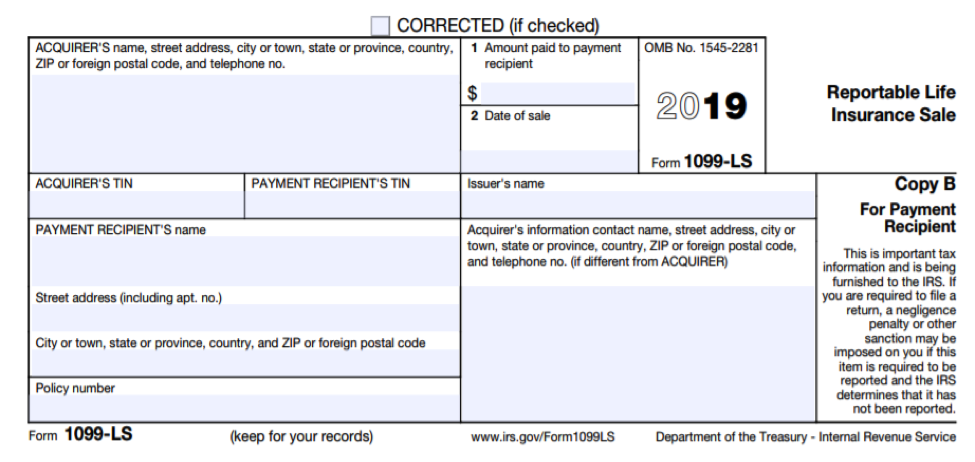

Is insurance 1099 reportable. 1112021 Use a 1099-NEC form to report nonemployee compensation. The 1099 will report the distribution amount of 50000 and also report that 0 is taxable. You do not have to send a 1099-MISC form to corporations nor to limited liability companies which have made an election to be treated as corporations for income tax purposes.

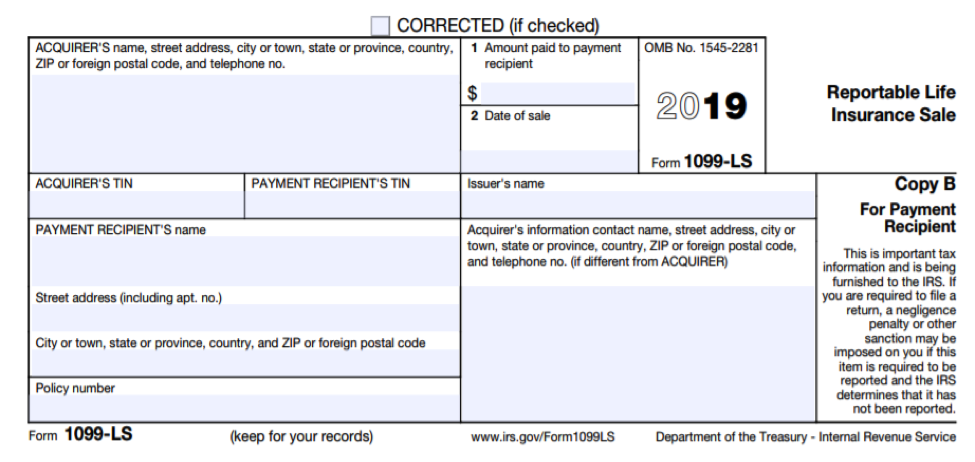

212011 Actually the fact that you received the 1099-Misc does not mean that this your taxable gain. 1282020 In my mind the 1099 instructions are clear that it is the insurance companies that are to report these payments on 1099s not us as the insurance company is not the one providing the health and medical service. 2182021 About Form 1099-LS Reportable Life Insurance Sale File Form 1099-LS if you are the acquirer of a life insurance contract or any interest in a life insurance contract in a reportable policy sale.

For example lets say a company hired a contractor to redesign the companys website and paid them 1000 for the project. Other forms of compensation for services. 2102021 Providers of Form 1099-LTC are typically insurance companies or governmental units among others.

Generally speaking if you receive an insurance payment or other reimbursement that is more than your adjusted basis in the destroyed damaged or stolen property you have a gain from the casualty or theft. Nonemployee compensation includes the following payment types to independent contractors. 1232020 Although most payments to corporations are not 1099-MISC and 1099-NEC reportable there are some exceptions.

The company would send them and the IRS a 1099-MISC. Failure to keep up with regulatory changes leads to failure to maintain compliance which leads to negative consequences such as penalties. But with the new 1099s box 6 the explanation is not very clear.

These common forms of 1099s are just the tip of the iceberg. If they know that there is 361796 of taxable gain implying that it is includible in income it seems that they must issue a Form 1099-R. Employees receive a W-2 from their employer each year and the employer pays taxes and benefits on their behalf.

More specifically Box 1 of the 1099-R will show the 50000 distribution. SUBSTITUTE FORM W-9 Request for Taxpayer Identification Number. Certain payments to corporations are reportable on Forms 1099-MISC and 1099-NEC.

Is not reportable on Form 1099-MISC. It would be highly unusual if not unheard of for an insurance agency to function as anything other than a corporation or a limited liability taxed as a corporation. Generally I have never seen an insurance company in normal claim processing circumstances of settling a casualty insurance claim issue a Form 1099.

Non-Reportable Reportable Non-Reportable Services Governments Consultants Tax-exempt entities Expert witness testimony Corporations unless for medical legal services or fish purchases Legal services Purchases of goods Medical services Insurance premiums. 10312014 Form 1099 and Health Insurance Reporting for Small Businesses Form 1099 Reporting Form 1099 reporting requirements can be extremely costly for small businesses due to the complexity of the rules and potential fines assessed for compliance failures. What that does mean is that the insured must keep excellent records of all the claims and payments made by the insurance company.

If any federal tax was withheld from any of these payments it is also reported on the 1099. Type of business entity which is used to determine whether or not payments to the vendor could be reportable on a 1099-MISC. Form 1099-R also reports profit-sharing and pension plan distributions payments resulting from insurance contracts survivor benefits and those received from annuities.

Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. 1242018 Form 1099-MISC Is for Business Payments Only The payments reported on the 1099-MISC should only be for business payments. An individual worker is either a W-2 employee or they are a 1099 Independent Contractor.

1282019 In the past their portion of the cost of their premiums was added to their regular contract pay on their 1099s and then they would deduct the cost of their health insurance on their tax return. 1162020 You will however receive a 1099-R reporting a 50000 distribution paid to you by your life insurance company. 2112020 The instructions for Form 1099-R only say that no reporting is required for surrender of the policy if the insurance company reasonably believes that none of the distribution is includible in income.

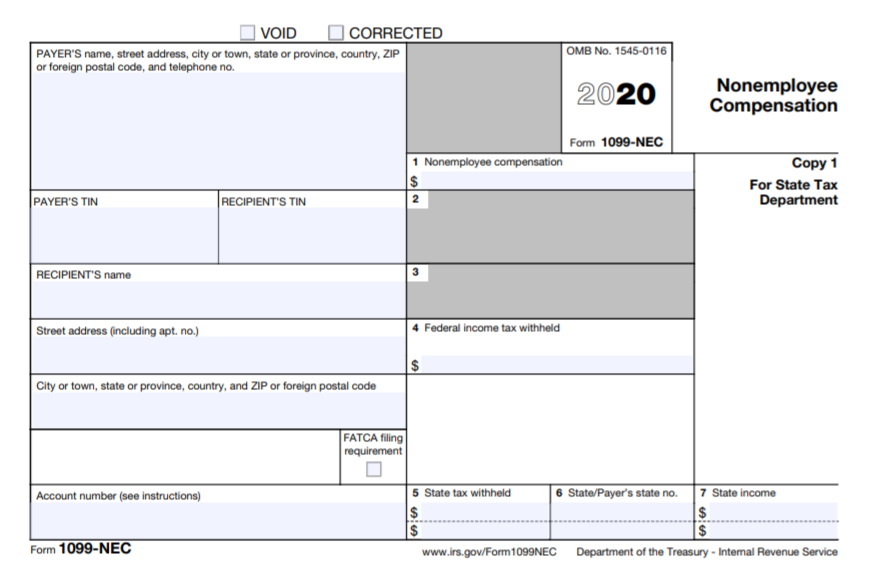

The Substitute Form W-9 serves to collect the following information. 1242019 The 1099-SB is filed by issuers of life insurance contracts or policies to report a sellers investment in the contract and the surrender amount due to transfer in a reportable policy sale. Payments reported include those made directly to.

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Form 1099 K Rasier Png 1024 696 Filing Taxes Tax Tax Deductions

Form 1099 K Rasier Png 1024 696 Filing Taxes Tax Tax Deductions

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Getting Irs Form 1099 Int Setup Was Never This Easy Download Irs Form 1099 Int Installer From Softpaz Https Www Softpaz 1099 Tax Form Irs Forms Tax Forms

Getting Irs Form 1099 Int Setup Was Never This Easy Download Irs Form 1099 Int Installer From Softpaz Https Www Softpaz 1099 Tax Form Irs Forms Tax Forms

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

F709 Generic3 Lettering Irs Forms Irs

F709 Generic3 Lettering Irs Forms Irs

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos Tax Help Lyft Driver Uber Driver

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos Tax Help Lyft Driver Uber Driver

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Irs Approved 1099 H Tax Forms File Form 1099 H Health Coverage Tax Credit Hctc Advance Payments If You Received Any Pension Benefits Tax Credits Tax Forms

Irs Approved 1099 H Tax Forms File Form 1099 H Health Coverage Tax Credit Hctc Advance Payments If You Received Any Pension Benefits Tax Credits Tax Forms

Post a Comment for "Is Insurance 1099 Reportable"