Liability Insurance Coverage In Ga

There are other circumstances where liability coverage can help protect you eg the person alleges you are at fault and makes a claim against you. Its important to remember that liability insurance never pays for your injuries or damages to your own property.

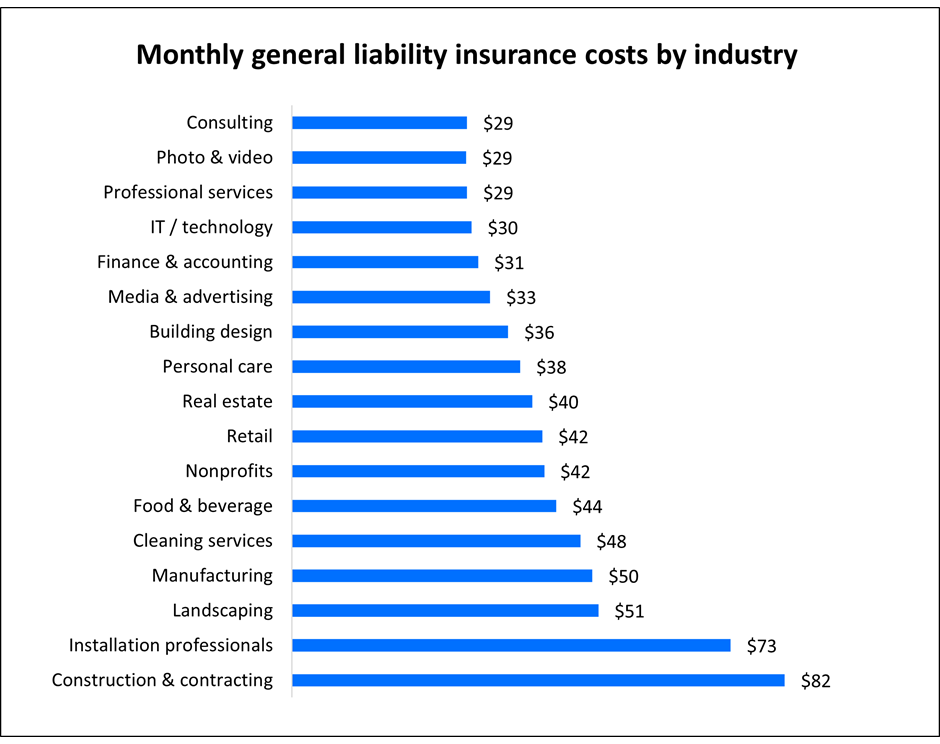

General Liability Insurance Cost Insureon

General Liability Insurance Cost Insureon

This means that the negligent driver is responsible for paying the property damage and personal injuries caused by the crash.

Liability insurance coverage in ga. Such claims could jeopardize the success and reputation of your business. Lets use the example. Well start with the only one absolutely required by law on any car that is required to be registered in this state liability insurance.

An injured victim would turn to the other drivers insurance company to cover his liability. About Commercial Liability Insurance for GA Businesses Commercial liability insurance also called business liability insurance and commercial general liability insurance protects your Georgia business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Drivers have the option to increase their level of liability protection if they would like.

3202021 Liability insurance coverage in Georgia Liability car insurance is the only insurance coverage required in the state of Georgia. Under Georgia law all motorists are required to have liability coverage of no less than 25000 per person and 50000 per accident. These types of insurance offer additional protection for drivers in the event that they are victims of a car accident and the other driver either has no insurance or doesnt have sufficient insurance.

The minimum limits of liability insurance required under Georgia law are. Georgia is a fault insurance state when dealing with liability issues and insurance coverage after a traffic accident. Bodily Injury Liability 25000 per person and 50000 per incident Property Damage Liability 25000 per incident.

Also known as commercial general liability insurance contractor liability insurance is a policy that covers your business from the risk of personal injury claims wrongful death property damage slip and fall on your business premises and claims of infringement by other businesses. 4202020 Bodily Injury Liability Bodily injury liability insurance is required in Georgia and it pays for the medical expenses funeral expenses lost wages and more for other parties if you cause an accident. Larry has his own 25000 policy of liability insurance.

A policy typically covers. 6152020 The minimum amounts of liability insurance that Georgia drivers must carry include bodily injury liability coverage of 25000 per person or 50000 per accident and 25000 in property damage coverage per accident. That means when you are trying to stack liability insurance policies the unicorn is the tortfeasor driving a borrowed vehicle.

1062014 While the policy grants coverage to the resident relative the policy strips away the liability coverage if the driver is driving an owned vehicle. GL coverage is designed to protect GA business owners from direct or indirect damages to another party. Larry Smith is driving his friend Karls car.

This type of liability. Georgia liquor liability insurance protects your establishment or event from unlawful actions of intoxicated customers with rates as low as 37mo. Liability insurance Georgia protects you against loss if your actions negligence or a condition of your property causes injury or death to a person or property belonging to another person is damaged or destroyed.

Get a fast quote and protect business now. Georgia general liability insurance is required by the state for most business owners. Uninsuredunderinsured motorist coverage provides protection for victims of car accidents caused by drivers who dont have auto insurance or who dont have enough insurance to cover the.

It pays for property damage or bodily injuries incurred from an accident that you cause. For GA businesses that manufacture distribute or sell products product liability coverage protects the business from claims resulting from claims of personal injury or property claims resulting from using a faulty product. GA Legal Liability Insurance.

Property Damage Liability Property damage liability insurance is another type of required coverage in Georgia. GA general liability insurance protects your business against property damage advertising injury claims personal injury claims and bodily injury claims. Your liability insurance helps pay for those damages caused by the actions of your business or your employees.

Without liability insurance you would be on your own if you are found legally responsible for any number of reasons. Georgia drivers are required to carry minimum liability insurance coverage for bodily injury 25000 per person and 50000 per accident and property damage 25000 per accident. Insurers issuing liability insurance policies for motor vehicles in this state are required to electronically report insurance information to this Departments insurance database Georgia Electronic Insurance Compliance System GEICS within thirty days of the date the insurance coverage is to begin.

Georgia Liability Insurance Coverage This series of blogs will talk about the different kinds of car insurance coverage that you mustmay have in Georgia.

Wedding Liability Insurance Event Venue Liquor Liability Wedsafe

Wedding Liability Insurance Event Venue Liquor Liability Wedsafe

Georgia Yoga Insurance Nacams Yoga Insurance Yoga Yoga Teacher

Georgia Yoga Insurance Nacams Yoga Insurance Yoga Yoga Teacher

General Insurance Quotes Insurance Quotes Accident Insurance Insurance

General Insurance Quotes Insurance Quotes Accident Insurance Insurance

Tumblr Car Care Car Insurance Insurance

Tumblr Car Care Car Insurance Insurance

Pin On No Insurance No Worries We Have Solutions

Pin On No Insurance No Worries We Have Solutions

Auto Liability Insurance Is A Type Of Car Insurance Coverage Drivers In Most States Are Required To Have Car Insurance Liability Insurance Insurance Coverage

Auto Liability Insurance Is A Type Of Car Insurance Coverage Drivers In Most States Are Required To Have Car Insurance Liability Insurance Insurance Coverage

Intresting Facts On Auto Insurance Car Insurance Insurance Georgia Law

Intresting Facts On Auto Insurance Car Insurance Insurance Georgia Law

Quick Arizona Car Insurance Quote Watch Video Here Http Bestcar Solutions Quick Arizona Car In Insurance Quotes Car Insurance Tips Auto Insurance Quotes

Quick Arizona Car Insurance Quote Watch Video Here Http Bestcar Solutions Quick Arizona Car In Insurance Quotes Car Insurance Tips Auto Insurance Quotes

Georgia Car Insurance Quotes Coverage Requirements Georgia Car Insur Car Coverage Georgia Auto Insurance Quotes Insurance Quotes Car Insurance

Georgia Car Insurance Quotes Coverage Requirements Georgia Car Insur Car Coverage Georgia Auto Insurance Quotes Insurance Quotes Car Insurance

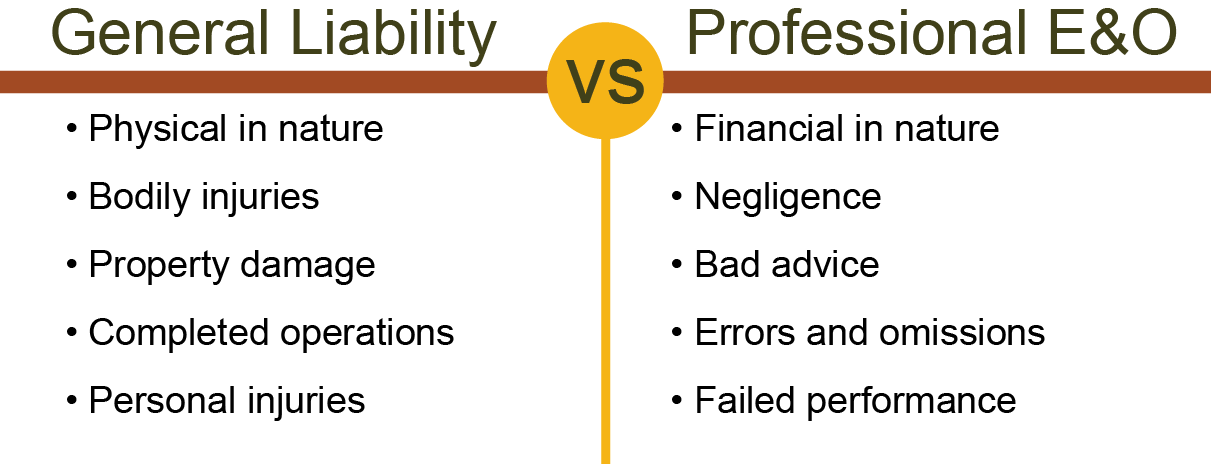

General Liability Vs Professional Liability

General Liability Vs Professional Liability

This Virginia Car Insurance Comparison Chart Shows Why Auto Insurance Rates Vary So Much For Different Drivers

This Virginia Car Insurance Comparison Chart Shows Why Auto Insurance Rates Vary So Much For Different Drivers

Insurance Quote Experts Is Your One Stop Insurance Comparison Website We Will Help You To Save Your Time And Money When Shopping For Any Major Type Of Insuranc

Insurance Quote Experts Is Your One Stop Insurance Comparison Website We Will Help You To Save Your Time And Money When Shopping For Any Major Type Of Insuranc

Get Lower Car Insurance Quotes Compare Rates Whygetinsurance Auto Insurance Quotes Car Insurance Insurance Quotes

Get Lower Car Insurance Quotes Compare Rates Whygetinsurance Auto Insurance Quotes Car Insurance Insurance Quotes

Business Insurance Looking For General Liability Workers Compensation Bonds No Matter Commercial Insurance Business Insurance Small Business Insurance

Business Insurance Looking For General Liability Workers Compensation Bonds No Matter Commercial Insurance Business Insurance Small Business Insurance

General Liability Insurance Cost Insureon

General Liability Insurance Cost Insureon

I Am 20 Years Old And Have No Diploma How Can I Insure Myself Insurance Quotes Cheap Car Insurance Quotes Auto Insurance Quotes

I Am 20 Years Old And Have No Diploma How Can I Insure Myself Insurance Quotes Cheap Car Insurance Quotes Auto Insurance Quotes

Post a Comment for "Liability Insurance Coverage In Ga"