Insurance Reimbursement Journal Entry

Bank for payments to an insurance company for business insurance. 2152011 Your insurance company cash advances andor reimbursements will following along the same lines.

Accounting For Insurance Claim Destruction Of Asset Manager Forum

And assist with claim filing and claim audits.

Insurance reimbursement journal entry. This usually happens when net book value of the property book value minus accumulated depreciation is more than the amount reimbursed. The process is split into three stages as follows. DR Bank CR Insurance company receivabledebtor Insurance company pays out.

However the insurer may still issue payments to reimburse the entity for certain fixed costs. The expense is posted and a liability established to the employee. I receive a reimbursement check from my insurance company for a claim I filed.

At the time of expenses met by him-. If full claim is receivable the journal entry is as follows. These processing options specify how the system assigns information to the Explanation fields on the journal entry that the system creates for expense reimbursement.

Under perpetual system however inventory balance is updated regularly throughout the accounting period. A basic insurance journal entry is Debit. The following journal entry may therefore be recorded to account for the loss or theft of inventory stores and spares.

If claim is received the journal entry is aa follows. Insurance claim receivable ac dr. Sometimes the insurance company will pay you less than the amount you paid.

Company-A paid 10000 as insurance premium in the month of December the insurance premium belongs to the following calendar year hence it doesnt become due until January of the next year. 472017 Accounting Treatment For Insurance Premium Learn The Journal Entries For Insurance Premium Income Paid In Advance Payment Claim Settlement. That may be why the refund.

Claim receivable is asset so debited. The journal entries for the stolen goods and insurance claim. 1132019 Determine the inventory lost and prepare the journal entry on this store books to recognize the inventory lost as well as the insurance reimbursement.

1 Legal Expenses ac Dr. Debit accumulated depreciation - vehicle for the amount in this account credit gain loss. 322010 So in the FY 2009-10 two months insurance premium will be shown as advance payment of expenses Pre paid Expenses under the group loans and advances or current assets and on the first day of the next year FY 2010-11 in this case prepaid insurance expenses entry which was made on 31st March 2009 is required to be reversed.

I deposited the check into my bank account and need to know how I record this into Sage 50. The employee is reimbursed and the liability is cleared. Cost of goods available for sale Beginning inventory Purchases 24000 23000 Rs.

It will ease your analytical pain. Of course that will then CR cash and DB the same insurance expense GL account. At the end of December the company will record this into their journal book using the below journal entry for prepaid expenses.

Specify the value that the system assigns to the Explanation field EXA on the journal entries that it generates. This is accomplished with a debit of 1000 to Insurance Expense and a credit of 1000 to Prepaid Insurance. I also need to know how to take it from my bank account and then add it to a GL account that I used for the repair costs that have already when paid out of that GL account.

Debit gain loss credit fixed asset account for the amount in this account. If this is the case record the entries as. Being Legal Expenses related to the company paid by the MrX which has to be reimburse At the time of Reimbursement of amount-.

Insurance Proceed on damaged property. Using the Gross Profit Method. 10242019 The journal entries below act as a quick reference for accounting for insurance proceeds.

Deposit the ins check and use the gainloss account as the source from account for the deposit. 10202018 Create an income account called gainloss on asset then do the journal entries. DR Insurance company receivabledebtor CR Purchases Cost of Sales Insurance claim approved.

Write off the damaged inventory to the impairment of inventory account. C Set up General Ledger accounts to capture all of these types of spending and reimbursement related to these two types of losses. Any inventory pilferage will need to be accounted for in a similar manner to the normal inventory issues during the period.

Debit Loss on Insurance Settlement. Claim receivable was asset but now claim received so credited. Some insurance payments can go on to the Profit and Loss Report and some must go on the Balance Sheet.

The insurance company probably explained same in a cover letter. Not all insurance payments premiums are deductible business expenses. On December 31 the company writes an adjusting entry to record the insurance expense that was used up expired and to reduce the amount that remains prepaid.

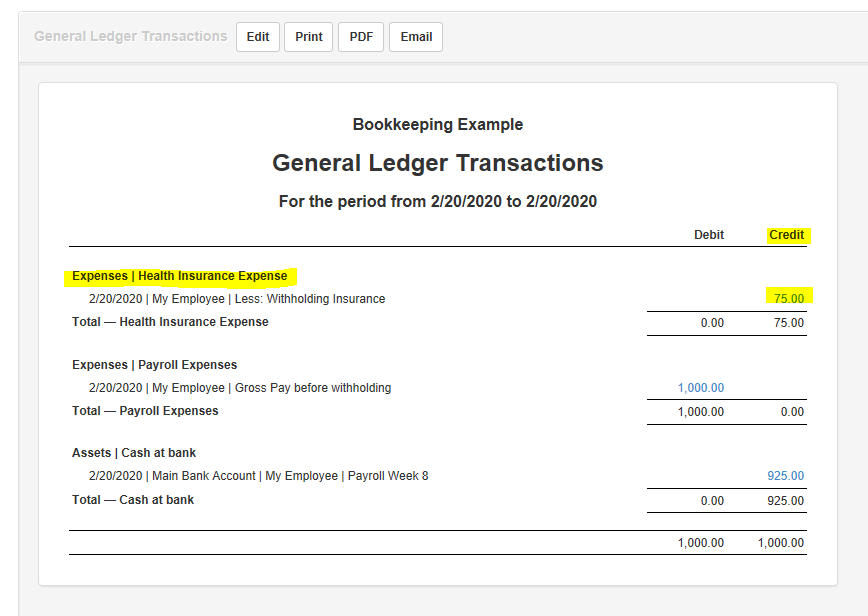

11122019 In order to process the reimbursed employee expenses transaction two bookkeeping journal entries need to be posted. This same adjusting entry will be prepared at the end of each of the next 11. Receive the cash from the insurance company.

To loss by fire ac. Next step is that you will have to figure out the refund due each covered employee as a percentage of total and then make a payment to the employee to pass on the premium refund. Cash comes in so debited.

When the claim is agreed set up an accounts receivable due from the insurance company. To insurance claim receivable ac. 12242020 The amount of reimbursement under this policy is based on a firms profit history.

If an organization has a continuing history of sustaining losses the insurer will not reimburse it for lost profits since there were no profits to lose. Use the supplier name. Brokerage Fees or Commission As a business owner who is concerned about the risk of loss insurance is designed to secure your business against future occurrences that might lead to loss of asset or properties.

Telepractice For Pediatric Dysphagia A Case Study Malandraki International Journal Of Telerehabilitation Pediatrics Case Study Dysphagia

Telepractice For Pediatric Dysphagia A Case Study Malandraki International Journal Of Telerehabilitation Pediatrics Case Study Dysphagia

Template Net Mileage Reimbursement Form 9 Free Sample Example Format Be873f6f Resumesample Resumefo How To Memorize Things Funeral Program Template Templates

Template Net Mileage Reimbursement Form 9 Free Sample Example Format Be873f6f Resumesample Resumefo How To Memorize Things Funeral Program Template Templates

Entry Level Paralegal Resume Inspirational Resume Objective For Paralegal Wikirian Resume Format In Word Resume Objective Administrative Assistant Resume

Entry Level Paralegal Resume Inspirational Resume Objective For Paralegal Wikirian Resume Format In Word Resume Objective Administrative Assistant Resume

Mileage Log Mileage Log Printable Mileage Tracker Printable Business Printables

Mileage Log Mileage Log Printable Mileage Tracker Printable Business Printables

More Information Button More Information Office Journal Buttons

More Information Button More Information Office Journal Buttons

How To Sync Paypal With Quickbooks Online Quickbooks Online Quickbooks Online

How To Sync Paypal With Quickbooks Online Quickbooks Online Quickbooks Online

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintain Cash Flow Statement Cash Budget Statement Template

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintain Cash Flow Statement Cash Budget Statement Template

Solved The December 31 Inventory Count Of Computer Suppli Chegg Com

Solved The December 31 Inventory Count Of Computer Suppli Chegg Com

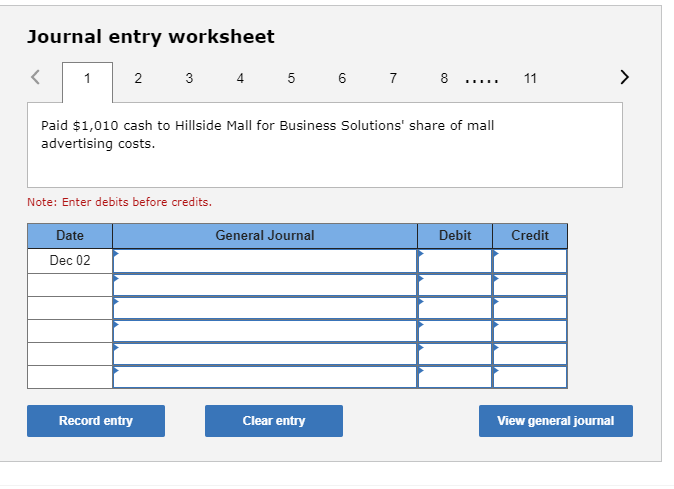

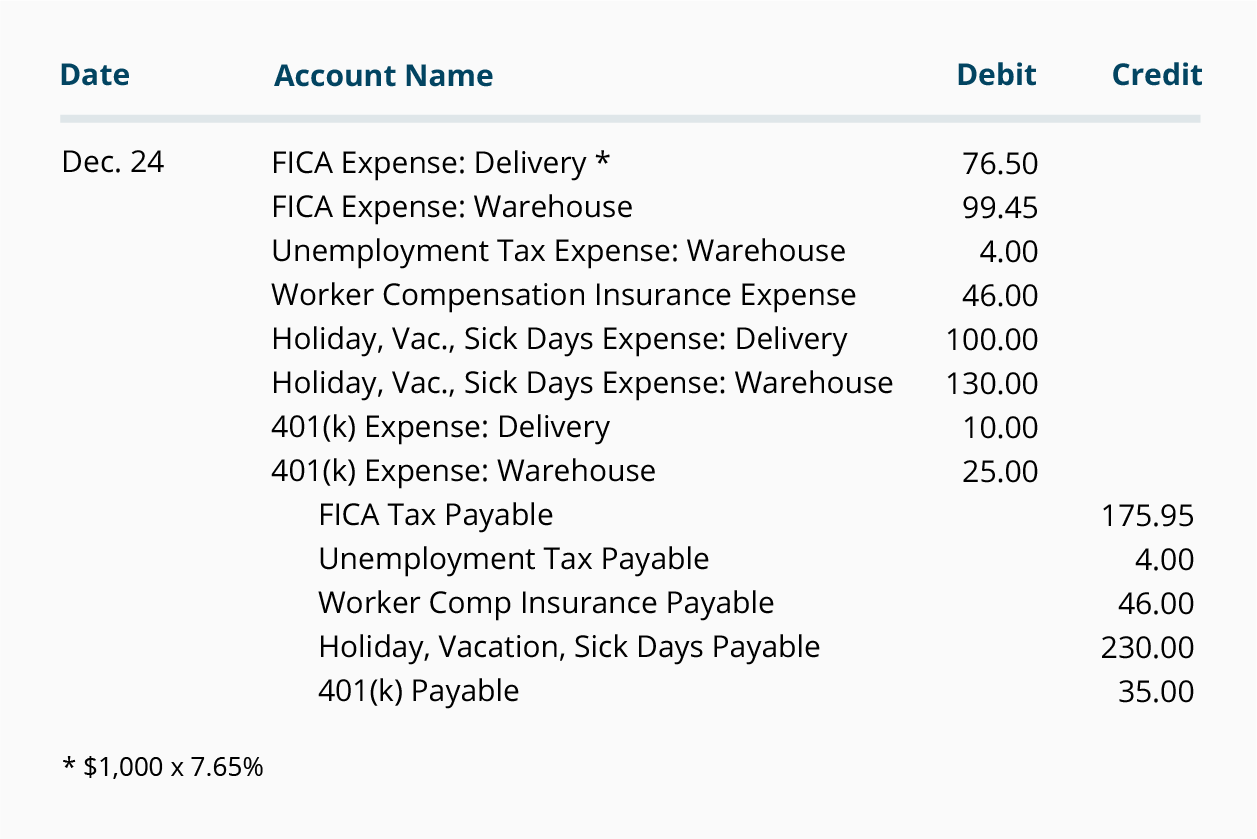

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Use Journal Entries To Record Transactions And Post To T Accounts

Use Journal Entries To Record Transactions And Post To T Accounts

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Examples Of How To Write A Resume Core Competencies Income Tax Return Financial Accounting

Examples Of How To Write A Resume Core Competencies Income Tax Return Financial Accounting

Claim Denials 15 Ways To Fight Back Medical Coding Training Medical Coding Medical Billing And Coding

Claim Denials 15 Ways To Fight Back Medical Coding Training Medical Coding Medical Billing And Coding

Pin By Edwin Nyangena On Cover Letter For Resume Engineering Resume Templates Engineering Resume Resume

Pin By Edwin Nyangena On Cover Letter For Resume Engineering Resume Templates Engineering Resume Resume

Process Fmea Example Project Management Analysis Management

Process Fmea Example Project Management Analysis Management

Non Profit And Payroll Accounting Examples Of Payroll Journal Entries For Salaries

Employment Physical Form Template Beautiful Physical Assessment Form Template Stagingusasport Medical Journals Social Determinants Of Health Journal Template

Employment Physical Form Template Beautiful Physical Assessment Form Template Stagingusasport Medical Journals Social Determinants Of Health Journal Template

Daily Vehicle Inspection Form Template Beautiful Vehicle Inspection Form Template Form Resume Exa Checklist Template Vehicle Inspection Marketing Plan Template

Daily Vehicle Inspection Form Template Beautiful Vehicle Inspection Form Template Form Resume Exa Checklist Template Vehicle Inspection Marketing Plan Template

Free Expenses Claim Form Excel Template Download Excel Templates Templates Spreadsheet Template

Free Expenses Claim Form Excel Template Download Excel Templates Templates Spreadsheet Template

Post a Comment for "Insurance Reimbursement Journal Entry"