Flood Insurance Zone Ae Cost

Coverage amounts and type of coverage federal government or private. The BFE is the elevation at which the NFIP estimates there is a 1 chance of floodwaters reaching or surpassing in any one year.

Private Oversized North Port Lot On 359 Acres Flood Insurance Investing In Land Flood

Private Oversized North Port Lot On 359 Acres Flood Insurance Investing In Land Flood

342021 How much is flood insurance.

Flood insurance zone ae cost. The average annual flood insurance cost in 2018 was 642 according to the Insurance Information Institute and the average amount of flood coverage was 257000. These regions are clearly defined in Flood Insurance Rate Maps and are paired with detailed information about base flood. We found that rates for a property in the same flood zone but with a different BFE can differ by nearly 600 a year.

Outside of coastal areas flood zone AE has the highest premiums. Well there are a few things that have a major impact on flood premiums in these zones. Rates of June 19 2017.

Annual flood insurance rates through the NFIP vary based on your flood zone and the structure of your house. 10182017 Another factor that impacts flood insurance costs is its base flood elevation BFE. Flood Nerds always get the best price for flood insurance.

Home insurance policies do not cover floods which means youll need a separate flood policy to be fully protected. The average flood claim in 2018 was 42 580 down from 91735 in 2017 the year of Hurricanes Harvey Irma and Maria. These are generally because most of the structures have a negative base flood elevation.

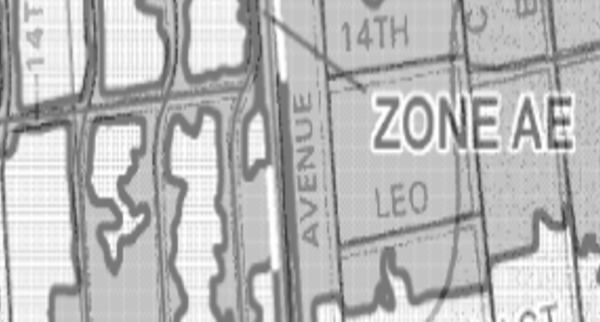

The National Flood Insurance Program assigns the letters B C and X to areas. So what determines the premiums of these zones. 4222019 Flood zone AE also referred to as the 100 year flood zone has the highest premiums other than coastal areas.

4272020 By comparison the average flood insurance claim in 2018 was more than 40000 so 5000 is not going to go very far. Changes in flood zones and BFEs can have a significant impact on building requirements and flood insurance costs. While coverage for low-risk properties can be as little as 100 a year high-risk coastal properties can cost upwards of 10000 a year to insure.

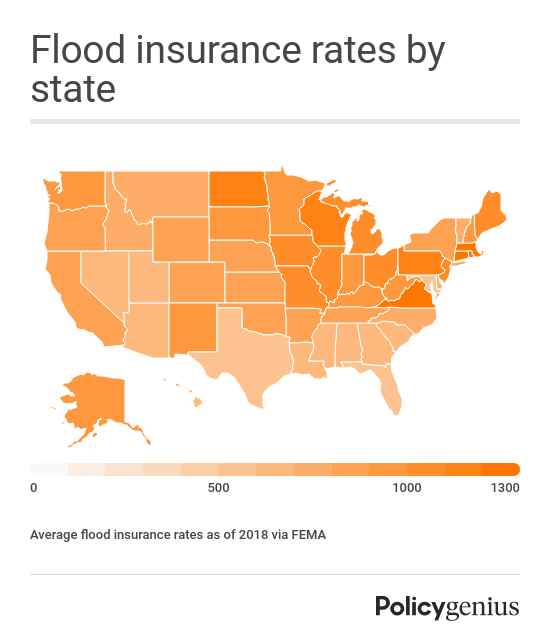

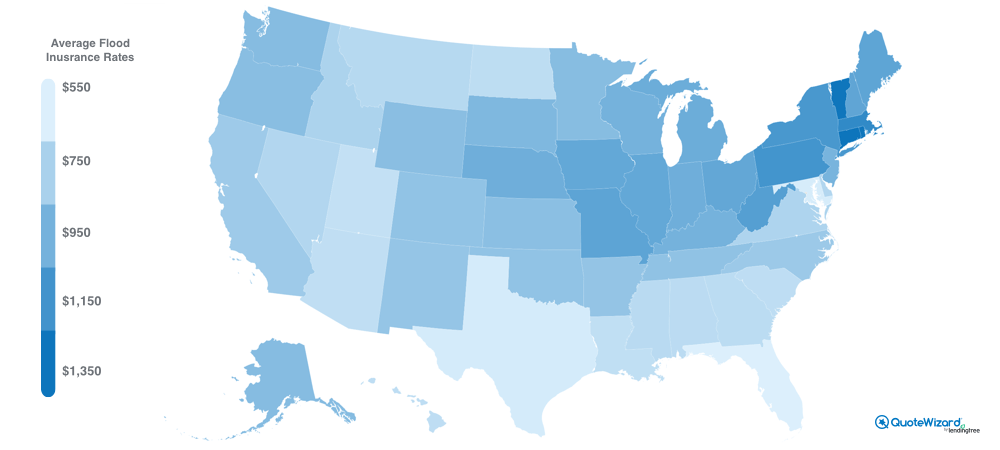

Costs vary by state and can be as cheap as 550 a year. 142021 The average cost of National Flood Insurance Program NFIP coverage was 707 according to the latest data provided by the Federal Emergency Management Agency FEMA. The Flood Nerds shop all options so we can get a more reasonable premium.

6192017 The chart above shows Flood Insurance costs for Florida homes that qualify for the Preferred Risk Program. Depending on several factorswhere your house is located how its built the propertys elevation and how often you occupy the homeflood insurance rates can range from just 65 to more than 10000. The flood zone determination and the flood zone significantly affects the cost of flood zone AE insurance.

7192020 Flood zone AE also referred to as the 100 year flood zone has the highest premiums other than coastal areas. The average cost of flood insurance in 2018 was 699 per year or 58 a month through the National Flood Insurance Program NFIP. 1152020 The cost of flood insurance varies according to several factors such as the location and age of the insured structure.

The average cost of flood insurance in Texas is 634 per year for policies purchased through the NFIP but rates can vary significantly. Defining AE flood zones. 12302020 On flood maps in coastal communities Zone AO usually marks areas at risk of flooding from wave overtopping where waves are expected to wash over the crest of a dune or bluff and flow down into the area beyond.

The annual premium for residential NFIP flood insurance averaged 700. AE flood zones are areas that present a 1 annual chance of flooding and a 26 chance over the life of a 30-year mortgage according to FEMA. 3282018 Cost of flood insurance in Texas.

Ive seen flood zone AE insurance policies with a cost of over 5000. Well there are a few things that have a major impact on flood premiums in these zones. These are generally because most of the structures have a negative base flood elevation.

Flood insurance rates vary from home to home based on a number of factors including the homes. So what determines the premiums of these zones. Additionally such localities are considered to have a 26 percent chance of flooding in the course of a 30-year mortgage.

Base Flood Elevations BFEs in these flood zones vary along the coast and with distance inland. Give us a call at 850 244-2111 or get your quote online. In this video we talk about some of those things that determine the rate.

In low- to moderate-risk areas premiums range from roughly 130 to 450 per year for homes. Buy flood insurance today.

Flood Zones Insurance Ri Shoreline Change Special Area Management Plan

Preliminary Flood Insurance Rate Maps Firms City Of Marco Island Florida

Preliminary Flood Insurance Rate Maps Firms City Of Marco Island Florida

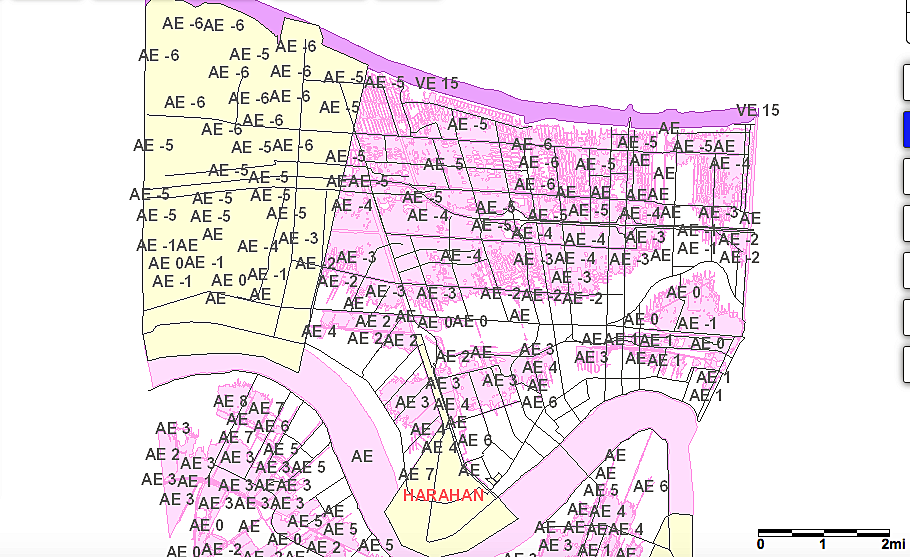

Cost Of Flood Insurance Rises Along With Worries Flood Insurance Flood Plaquemines Parish

Cost Of Flood Insurance Rises Along With Worries Flood Insurance Flood Plaquemines Parish

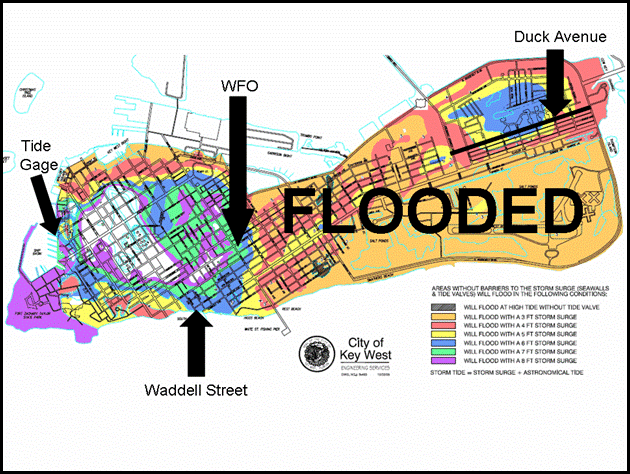

Is Your Flood Insurance Going Up Part Viii John Parce Real Estate Key West

Is Your Flood Insurance Going Up Part Viii John Parce Real Estate Key West

Rebates On Real Estate The Low Down On Flood Insurance

Flood Insurance Resources Borough Of Oakland Nj

Flood Insurance Resources Borough Of Oakland Nj

How Much Does Flood Insurance Cost In 2021 Policygenius

How Much Does Flood Insurance Cost In 2021 Policygenius

Trump S Environmental Rollback Will Be Costly To Nc Flood Insurance Flood Lakefront Living

Trump S Environmental Rollback Will Be Costly To Nc Flood Insurance Flood Lakefront Living

Building In Flood Insurance Zones What To Know About Coastal Zone Engineering

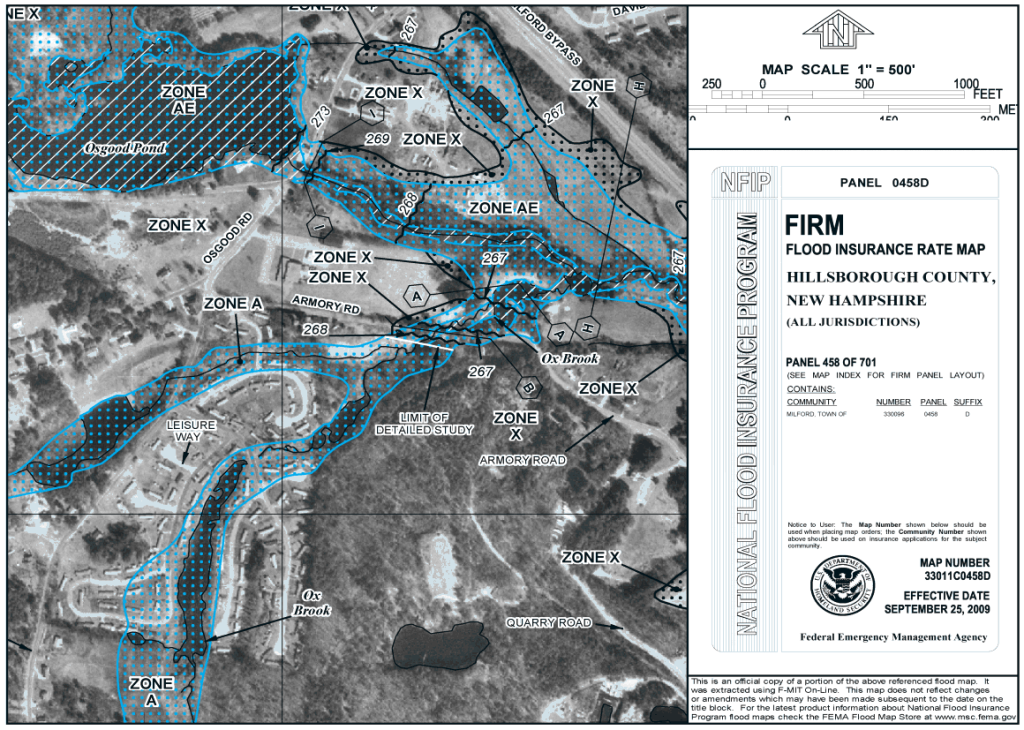

Flood Zone Maps Designations Explained Rodgers Burton

Flood Zone Maps Designations Explained Rodgers Burton

Charleston Sc Flood Insurance Basics Guide Flood Insurance Insurance Quotes Flood

Charleston Sc Flood Insurance Basics Guide Flood Insurance Insurance Quotes Flood

Building In Flood Insurance Zones What To Know About Coastal Zone Engineering

How Much Does Flood Insurance Cost By State And Zone

How Much Does Flood Insurance Cost By State And Zone

Risk Fema Flood Zones And Insurance Premiums Massivecert Massively Easy Flood Certification

Risk Fema Flood Zones And Insurance Premiums Massivecert Massively Easy Flood Certification

Floodplain Information Maricopa County Az

Will Flood Insurance Rates Fall For Your Jefferson Parish Property Business News Nola Com

Will Flood Insurance Rates Fall For Your Jefferson Parish Property Business News Nola Com

Building In Flood Insurance Zones What To Know About Coastal Zone Engineering

Building In Flood Insurance Zones What To Know About Coastal Zone Engineering

Post a Comment for "Flood Insurance Zone Ae Cost"