Flood Insurance Rate Zone X

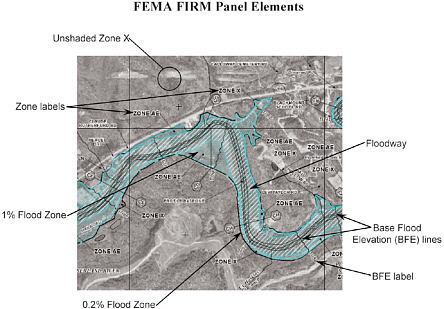

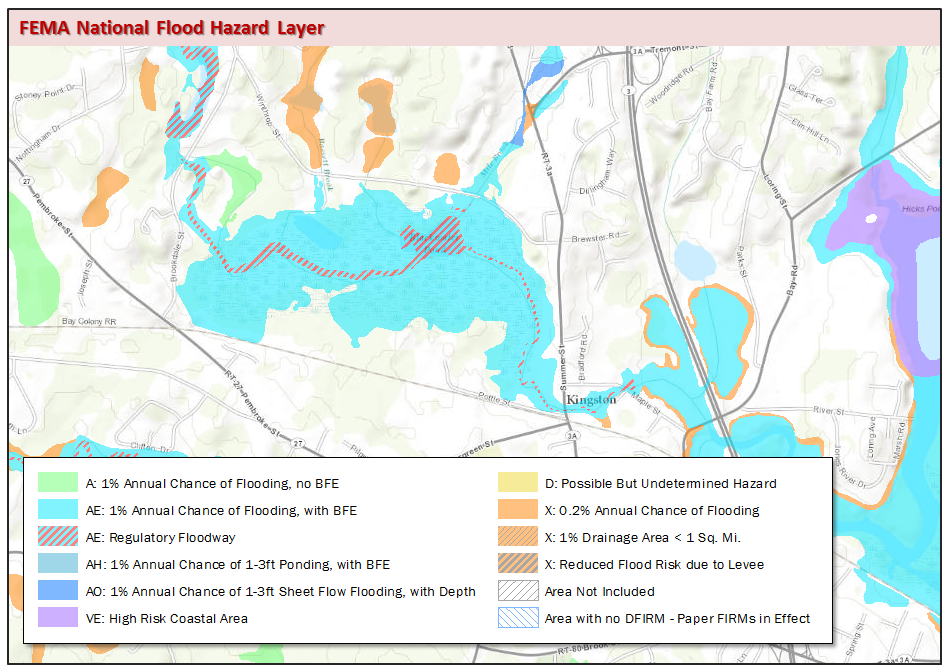

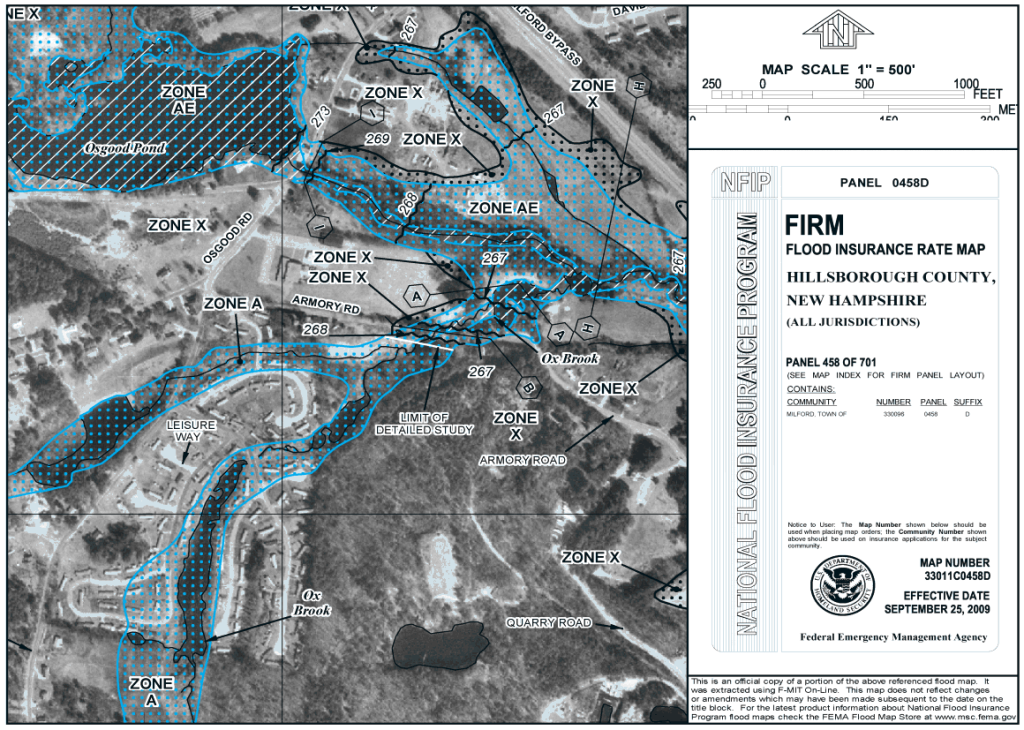

Communities use the maps to set minimum building requirements for coastal areas and floodplains. Flood maps known officially as Flood Insurance Rate Maps show areas of high- and moderate- to low-flood risk.

Flood zones are a way to define the flooding risk for different areas according to FEMA.

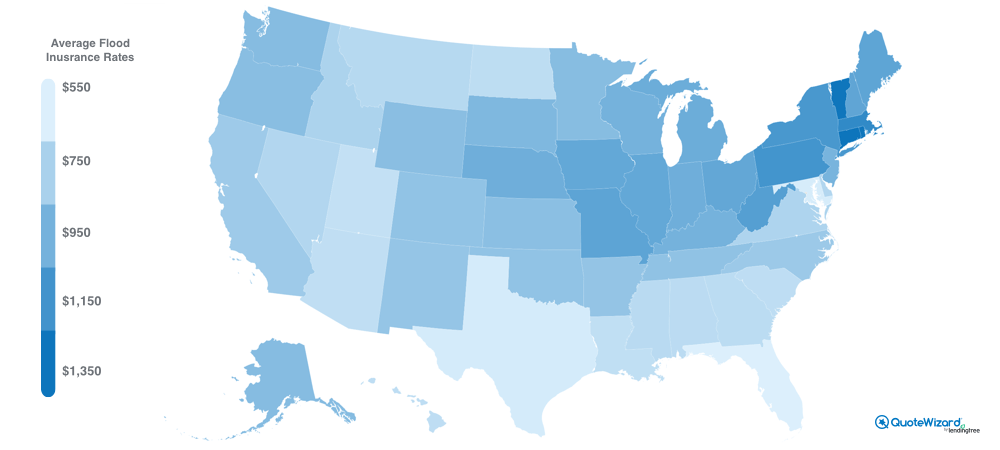

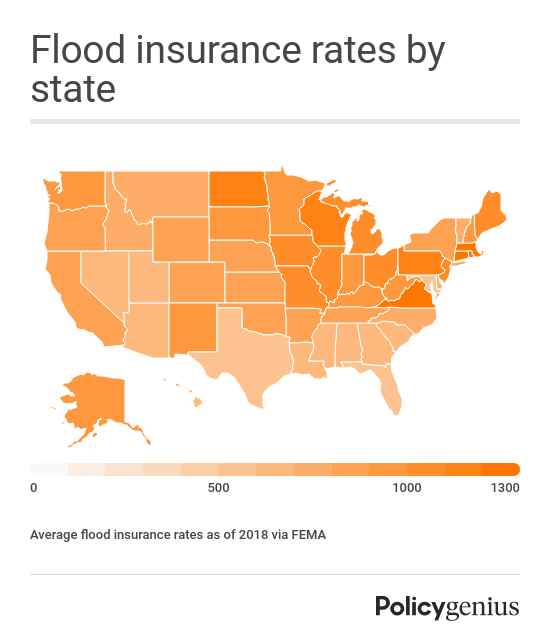

Flood insurance rate zone x. On flood maps in coastal communities Zone AO usually marks areas at risk of. Florida enjoys the cheapest flood insurance rates of 550 a year while Connecticut has the most expensive average rates at 1395 a year. 4272020 Preferred and Moderate Flood Zones include.

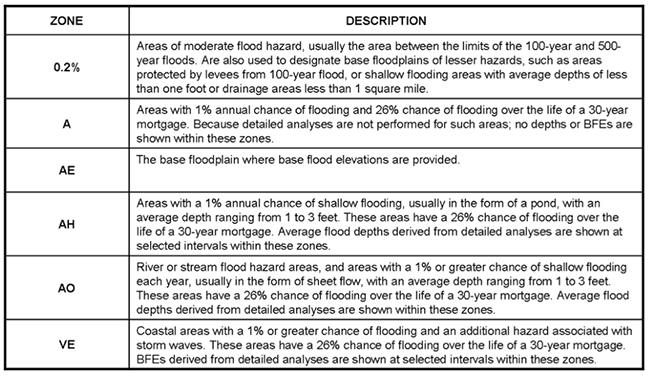

142021 The private flood insurance market is getting bigger and that may be better for flood insurance rates this according to a study conducted by consulting firm Milliman. Moderate-risk flood zones are labeled Zone B or Zone X shaded on the map These zones have a 02 annual chance of flood being equaled or exceeded Also referred to as a 500-year flood. 7182017 Buildings in B C and X zones qualify for standard or preferred rates.

342021 The Base Flood Elevation or BFE shown on the Flood Insurance Rate Map FIRM for high-risk flood zones indicates the water surface elevation resulting from a flood that has a 1 chance of equaling or exceeding that level in any given year. Annual flood insurance rates through the NFIP vary based on your flood zone and the structure of your house. This is usually identified as an X-flood zone.

This is usually identified as an X-flood zone. The figures below are for flood insurance policies through the NFIP which according to a study by the University of Pennsylvania accounts for between 96 and 97 of all residential flood insurance policies. Zone AO is used to map areas at risk of shallow flooding during a base 1-annual-chance flood where water with average depths of 1 to 3 feet flows over sloping ground.

So what determines the premiums of these zones. X is used on new and revised maps instead of C. Moderate flood hazard areas labeled Zone B or Zone X shaded are also shown on the FIRM but are not considered part of the Special Flood Hazard Area.

They are shown as a series of zones. The primary way to reduce your flood insurance cost is to increase your homes elevation. FEMAs low and moderate risk flood zones those outside the SFHA are those that begin with the letters X B or C Flood insurance is not required within these zones.

Well there are a few things that have a major impact on flood premiums in these zones. Your flood insurance rate will not change until the maps become effective on March 23 2021. 10182017 The type of flood zone you live in has a huge effect on the price of your flood insurance.

All flood hazard areas are defined as part of a Special Flood Hazard Area or SFHA. In the most extreme cases a home in a V zone can cost 100 or even 200 what it costs to insure a home in a B C or X zone. Zones B C and X are areas of minimal flood hazard from the principal source of flood in the area and determined to be outside the 02 percent annual chance floodplain.

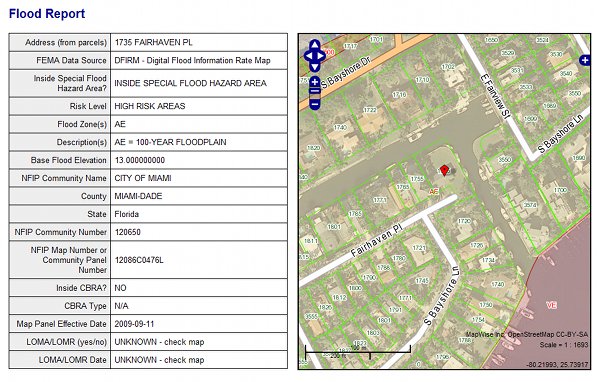

12302020 Zone AE indicates areas that have at least a 1-annual-chance of being flooded but where wave heights are less than 3 feet. 4222019 Flood zone AE also referred to as the 100 year flood zone has the highest premiums other than coastal areas. South Carolina flood insurance low-to Moderate Risk rate and cost.

See the 2021 rates for Preferred Risk flood insurance policies. The study looked at three states that account for over 50 of NFIP policies Florida Texas and Louisiana and found that an overwhelming number of homes in each state. Places Prone to Flooding Flood maps or Flood Insurance Rate Maps were developed to help insurance providers and homeowners understand the risk associated with living in and insuring homes in flood-prone areas.

Then we would suggest the government Preferred Risk Policy PRP which is a subsidized policy and has set flood insurance coverage limits see grid below. If a property covers two or more flood zones the insurer will rate the premiums based on the most hazardous zone. Lenders use them to determine flood insurance requirements.

These are generally because most of the structures have a negative base flood elevation. While coverage for low-risk properties can be as little as 100 a year high-risk coastal properties can cost upwards of 10000 a year to insure. 1152020 The average federal flood insurance policy costs about 700 a year with rates depending on your location and type of structure.

15 hours ago Zone Shaded X formerly Zone B moderate-risk zone 02 annual chance flood Zone AO areas of shallow flooding Zone AE high-risk zone 1 annual chance Flood Zone VE coastal high-hazard zone When will my flood insurance rate change. Find out if your community qualifies for a preferred rate on flood insurance. These zones could still have flood risk as historically more than 20 of NFIP claims are made by policyholders in.

3282017 The federal government designates areas with a minimal risk of flood as Zone X. This is Flood Zone X which is not lender required flood zone. Rhode Island flood insurance low-to Moderate Risk rate and cost.

Then we would suggest the government Preferred Risk Policy PRP which is a subsidized policy and has set flood insurance coverage limits see grid below. A and V zones pay more. The areas of minimal flood hazard which are the areas outside the SFHA and higher than the elevation of the 02-percent-annual-chance flood are labeled Zone C or Zone X unshaded.

852015 On the Flood Insurance Rate Map Zone X shaded refers to an area with moderate flooding risk while Zone X unshaded refers to an area with minimal flooding risk. This is Flood Zone X which is not lender required flood zone.

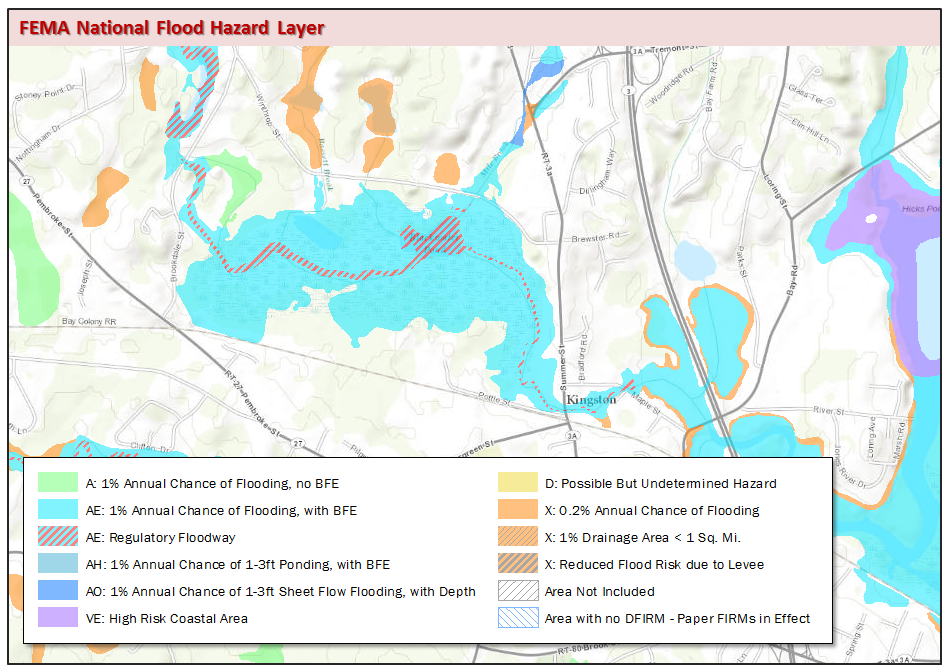

Florida Flood Zone Maps And Information

Florida Flood Zone Maps And Information

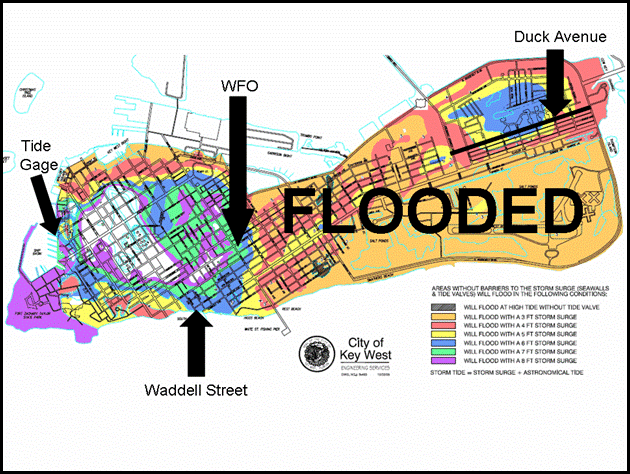

Is Your Flood Insurance Going Up Part Viii John Parce Real Estate Key West

Is Your Flood Insurance Going Up Part Viii John Parce Real Estate Key West

Department Of Engineering Flood Zones Flood Zone Definitions

What Are Flood Zones And Do I Need Flood Insurance Harris Insurance

What Are Flood Zones And Do I Need Flood Insurance Harris Insurance

Climate Resiliency Frequently Asked Questions

Climate Resiliency Frequently Asked Questions

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

3 Fema S Map Modernization Program Elevation Data For Floodplain Mapping The National Academies Press

3 Fema S Map Modernization Program Elevation Data For Floodplain Mapping The National Academies Press

Massachusetts Document Repository

Massachusetts Document Repository

How Much Does Flood Insurance Cost By State And Zone

How Much Does Flood Insurance Cost By State And Zone

Flood Zones Insurance Ri Shoreline Change Special Area Management Plan

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

New Fema Flood Maps Show Big Changes For Staten Island Homeowners Silive Com

New Fema Flood Maps Show Big Changes For Staten Island Homeowners Silive Com

Understanding Fema Flood Maps And Limitations First Street Foundation

Understanding Fema Flood Maps And Limitations First Street Foundation

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

Rebates On Real Estate The Low Down On Flood Insurance

Post a Comment for "Flood Insurance Rate Zone X"