Lemonade Insurance Value Chain

The result is Lemonade a technology-first and legacy-free insurance carrier offering a product that is instantaneous un-conflicted and downright. 3252019 Highlights Assurely and AXA XL provide insurance for officers of Security Token Offering companies and their investors Assurelys co-founder Ty Sagalow was also Chief Insurance Officer at SoftBank-backed insurtech Lemonade.

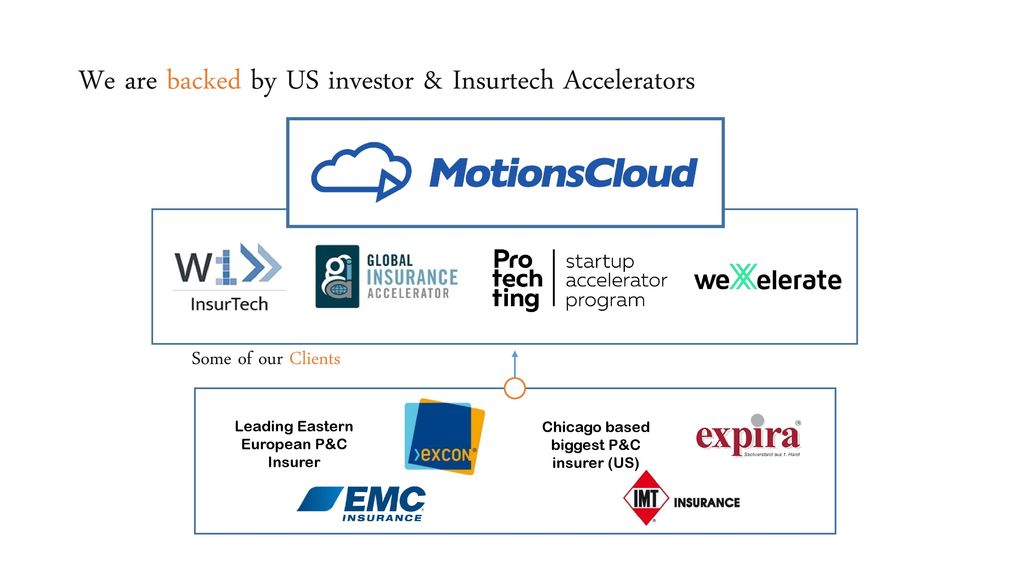

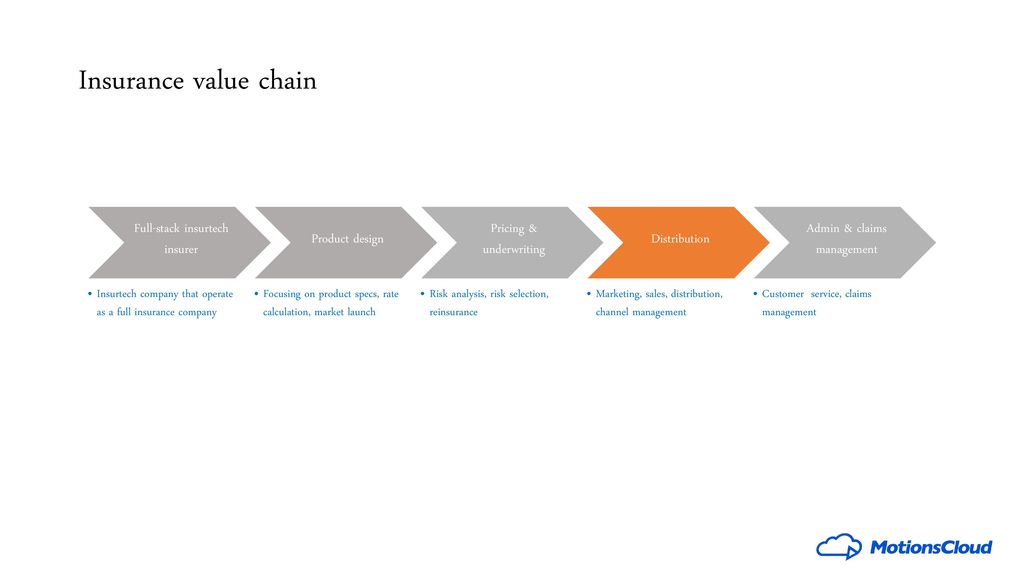

Insurtech In The Insurance Value Chain Of Today And Tomorrow Ppt Download

Insurtech In The Insurance Value Chain Of Today And Tomorrow Ppt Download

Greater efficiency and transparency will change the way people think about insurancefor the better.

Lemonade insurance value chain. 4212017 The company is looking to improve the insurance value chain and it is seeking to use technology-driven efficiencies to redefine an insurers role in its community. Goldman Sachs is leading the IPO and Lemonade plans to trade on the. If there is money left in the pool a fee of 20 percent will be charged.

This New York-based company applies artificial intelligence AI and blockchain to offer insurance to renters and homeowners. 7272020 Lemonade is a Public Benefit Corporation meaning that while we are about profit maximization over the long run that is not all we are about. In its IPO registration statement Lemonade revealed a substantial quota share reinsurance agreement with seven.

1052016 Currently Lemonade covers only renter insurance and homeowner insurance and the monthly price starts at 5 USD and 35 USD respectively. Insurance has remained fundamentally unchanged for centuries so an insurance product for todays consumer required re-architecting every part of the value chain. In its registration statement the company revealed ballooning losses alongside top.

As a full-stack insurer it redesigned almost all of the traditional insurance value chain to keep premiums low and offer renters and home insurance. 6132016 Lemonade is Peer to Peer insurance. Its business model charges a monthly fixed fee and allocates the rest of the sum to future claims.

New York NY USA A property and casualty peer to peer insurance that uses AI-powered claims analysis. No part of the value chain. Based on a dataset of 84 papers and industry studies we analyse the impact of digital transformation on the insurance sector using Porters value chain The.

And the company has developed an algorithmic claims processing system to increase the speed and accuracy of their claims processing decisions. Eighteen anti-fraud algorithms are run on image and video claims information from the customer and a response is given to within minutes. Our business decisions consider the greater good and the value we are looking to create is measured in many currencies money being but one of them.

672018 Insurance has remained fundamentally unchanged for centuries so an insurance product for todays consumer required re-architecting every part of the value chain We created Lemonade as a purpose-built technology-first vertically-integrated and legacy-free insurance carrier Worlds Only Public Benefit Insurance Company May 2016. Peer To Peer Mutual Platform Targets Health Insurance Peer To Peer Insurer Lemonade Launches In New York. At Lemonade small insurance groups pay a fixed fee into a claims pool.

Lemonade totally upends the traditional insurance model. RELATED PEER TO PEER INSURANCE NEWS. 12152015 Insurance has remained fundamentally unchanged for centuries so an insurance product for todays consumer required re-architecting every part of the value chain.

Wi th the righ t tools. P2P insurance company usually offers micro-insurance. Since those early days Lemonade has built on its promise to take the headache out of insurance for homeowners and renters.

Insurance has remained fundamentally unchanged for centuries so an insurance product for todays consumer required re-architecting every part of the value chain. The result is Lemonade a technology-first and legacy-free insurance carrier offering a product that is instantaneous un-conflicted and downright delightful. We created Lemonade as a purpose-built technology-first vertically-integrated and legacy-free insurance.

692020 Lemonade an insurance startup worth 2 billion filed financial paperwork on Monday to go public. Lemonade is Peer to Peer insurance. Lemonade has built a millennial-friendly insurance company that has digitally innovated two key stages of the insurance value chain.

AXA XL is also one of Lemonades reinsurers Part of due diligence relies on STO platform doing some vetting Due diligence is automated A. That 100M figure is a placeholder and is likely to rise by the time the company prices their IPO. Emerging technologies will bring convenience to customers and make insurers processes more efficient.

9102020 By Russ Banham Carrier Management The IPO of Lemonade in July highlights the value of leveraging ample reinsurance to move from startup phase to a public company which the online provider of renters insurance pulled off in a scant four years. 6122020 Lemonade a digital consumer insurance provider filed for a 100M IPO. 11132018 Lemonade a company offering home insurance policies is a pioneer in the InsurTech world where its use of machine learning ML goes beyond satisfying customers and driving efficiencies to underwriting risks and managing claims.

The company has built a paperless direct to consumer acquisition process. No Part Of The Insurance Value Chain Is Safe From Change. Lemonade widely utilizes smart contracts in its work.

912020 In this graphic provided by Capco purple represents traditional mergers and relations and green represents the new territory inhabited by Lemonade and. NEW P2P INSURANCE REPORT - Peer To Peer Insurance 2016. 732020 Lemonade says it wants to be an insurance company built from scratch on a digital substrate a contemporary business model and no legacy.

Airlines New Fee Gambit Revenue Management Hotel Management Airlines

Airlines New Fee Gambit Revenue Management Hotel Management Airlines

Automation Opportunities Across The Insurance Value Chain

Automation Opportunities Across The Insurance Value Chain

Insurtech In The Insurance Value Chain Of Today And Tomorrow Ppt Download

Insurtech In The Insurance Value Chain Of Today And Tomorrow Ppt Download

The Internet Of Trust Finance Development June 2016 Blockchain Finance Bank Blockchain Technology

The Internet Of Trust Finance Development June 2016 Blockchain Finance Bank Blockchain Technology

Insurtech 2020 Trends Innovation In Insurance Technology

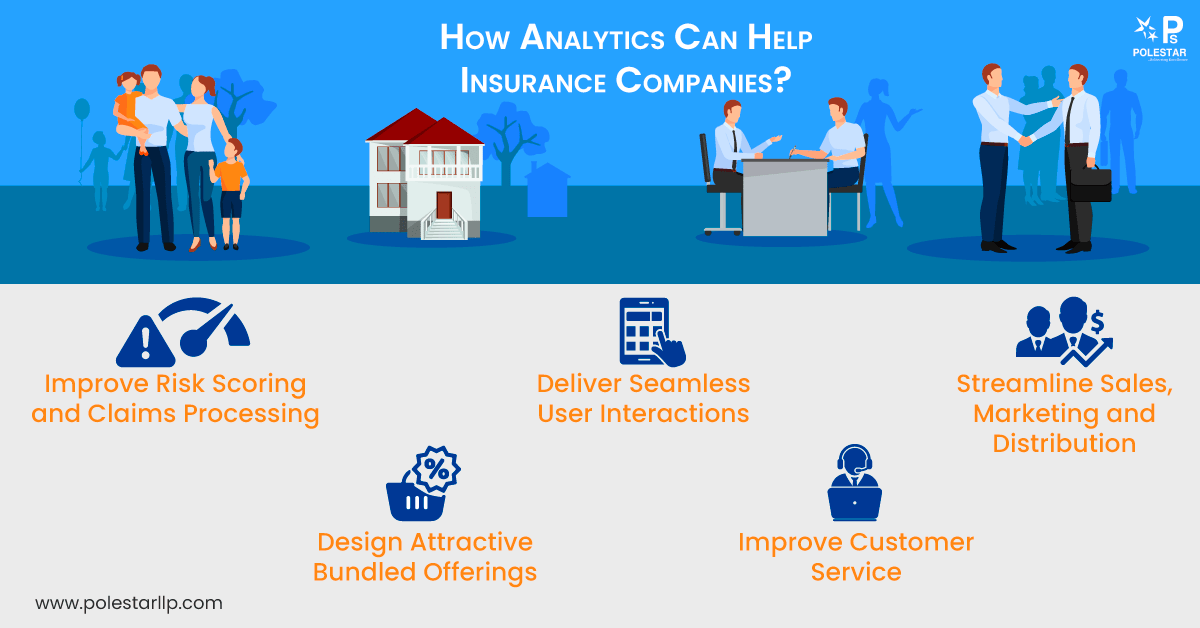

Top 5 Analytics Use Cases For Insurance Companies By Polestarsolutions Medium

Top 5 Analytics Use Cases For Insurance Companies By Polestarsolutions Medium

The Enablers Of Innovation In Insurance Finleap

The Enablers Of Innovation In Insurance Finleap

3 Reasons Why P2p Insurtech Start Ups Will Not Disrupt The Insurance Industry Insurance Industry Business Insurance Insurance

3 Reasons Why P2p Insurtech Start Ups Will Not Disrupt The Insurance Industry Insurance Industry Business Insurance Insurance

Transformation In Insurance Springerlink

Transformation In Insurance Springerlink

Finfographic Of Major Blockchain Consortium Projects And Baas Blockchain As A Service Globally It S Year Of R Evolut Blockchain Financial Services Fintech

Finfographic Of Major Blockchain Consortium Projects And Baas Blockchain As A Service Globally It S Year Of R Evolut Blockchain Financial Services Fintech

Munichreswissre Start Up Swiss Re Investing

Munichreswissre Start Up Swiss Re Investing

Transformation In Insurance Springerlink

Transformation In Insurance Springerlink

Insurtech Grouping Map Insurance Business Insurance Social Intelligence

Insurtech Grouping Map Insurance Business Insurance Social Intelligence

Automation Opportunities Across The Insurance Value Chain

Automation Opportunities Across The Insurance Value Chain

Market The New School Of Claim Settlement And How Startups Do It By Astorya Vc Medium

Market The New School Of Claim Settlement And How Startups Do It By Astorya Vc Medium

Lemonade Insurance Google Search Lemonade Renters Insurance Insurance

Lemonade Insurance Google Search Lemonade Renters Insurance Insurance

Insurtech And Fintech Banking And Insurance Enablement Sciencedirect

Insurtech And Fintech Banking And Insurance Enablement Sciencedirect

Post a Comment for "Lemonade Insurance Value Chain"