Flood Insurance Rate X

When will my flood insurance rate change. If a property covers two or more flood zones the insurer will rate the premiums based on the most hazardous zone.

What Are Flood Zones And Do I Need Flood Insurance Harris Insurance

What Are Flood Zones And Do I Need Flood Insurance Harris Insurance

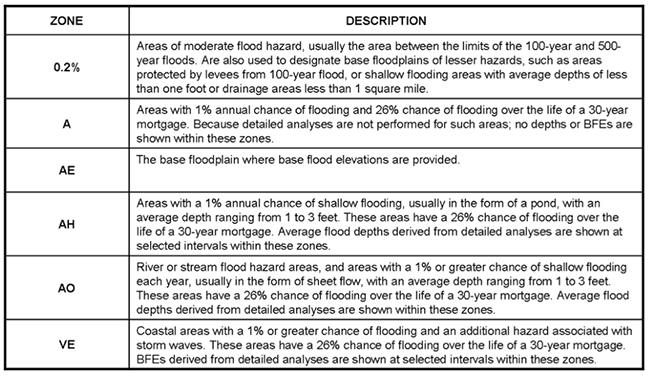

Moderate flood hazard areas are also shown on the Flood Insurance Rate Map FIRM and are the areas between the limits of the base flood and the 02 annual chance sometimes referred to as a 500-year flood Moderate Flood Zones are labeled by Zone B and Zone X.

Flood insurance rate x. 4272020 Zones V1-V30- Zone VE is used on new and revised maps in place of Zones V1-V30. 142021 The average cost of National Flood Insurance Program NFIP coverage was 707 according to the latest data provided by the Federal Emergency Management Agency FEMA. In the most extreme cases a home in a V zone can cost 100 or even 200 what it costs to insure a home in a B C or X zone.

Costs vary by state and can be as cheap as 550 a year. 8212019 The B C and X zones are in the 500 year flood plain and deemed not risky enough to require you to purchase flood insurance by your mortgage lender. Along the coast the flood map has delineated coastal SFHAs where the source of flooding is from coastal hazards such as storm surge and waves.

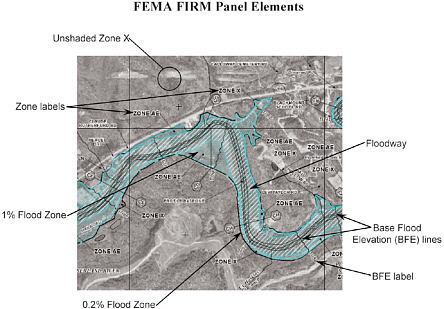

Places Prone to Flooding Flood maps or Flood Insurance Rate Maps were developed to help insurance providers and homeowners understand the risk associated with living in and insuring homes in flood-prone areas. Flood insurance cost depends largely on your homes risk. 4222019 The next thing that has a major impact on flood insurances rates in flood zone AE is the foundation type.

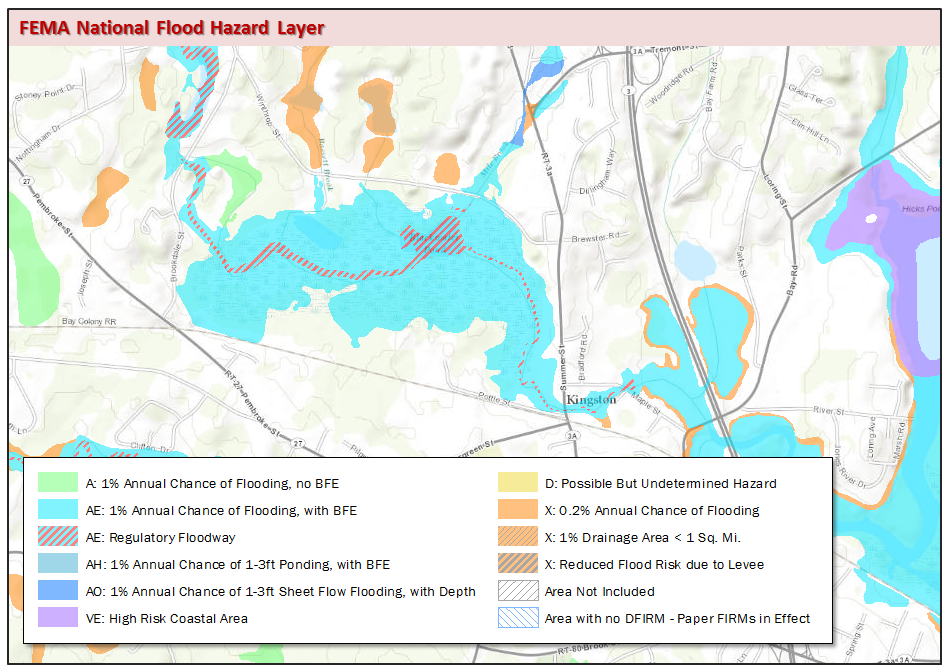

Two of the most influential factors in determining flood insurance costs are your homes location on a flood map and elevation. FEMA National Flood Insurance Program. Flood zones are a way to define the flooding risk for different areas according to FEMA.

All flood hazard areas are defined as part of a Special Flood Hazard Area or SFHA. Zone AE high-risk zone 1 annual chance Flood Zone VE coastal high-hazard zone. 3282017 The federal government designates areas with a minimal risk of flood as Zone X.

342021 The average annual flood insurance cost in 2018 was 642 according to the Insurance Information Institute and the average amount of flood coverage was 257000. The National Flood Insurance Program or NFIP offers flood insurance through FEMA. For example each NFIP flood insurance policy has an annual surcharge typically 25.

Coverage amounts and type of coverage federal government or private. 1022013 The main difference between the two types of flood vents is that fewer of the engineered flood vents are required to meet NFIP requirements. Home insurance policies do not cover floods which means youll need a separate flood policy to be fully protected.

The average flood claim in 2018 was 42 580 down from 91735 in 2017 the year of Hurricanes Harvey Irma and Maria. 1062014 There are many items that go into determine the premiums for flood insurance including but not limited to the replacement cost of the home how much coverage you are looking for deductibles how much risk the homeowner is willing to take on the flood zone. Annual premium in High-Risk flood zone is 317990 This option will take properties that have had one flood loss as long as it has been more than five years and the payout was under 100000 on the claim.

For example a non-engineered 8 x 16 vent is rated at 128 square inches while an engineered 8 x 16 is rated at 205 square inches. Either X A or V this can change rates drastically the base flood elevation BFE for the property the. The average cost of flood insurance in 2018 was 699 per year or 58 a month through the National Flood Insurance Program NFIP.

As long as your community is in one of the nearly 21000 communities that participate in the program you should be eligible for both types of NFIP coverage building property and. 1152020 The cost of flood insurance varies according to several factors such as the location and age of the insured structure. Above grade is a crawlspace that sits above ground and subgrade is going to.

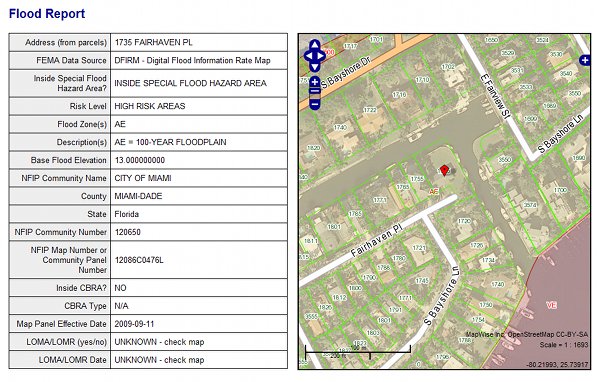

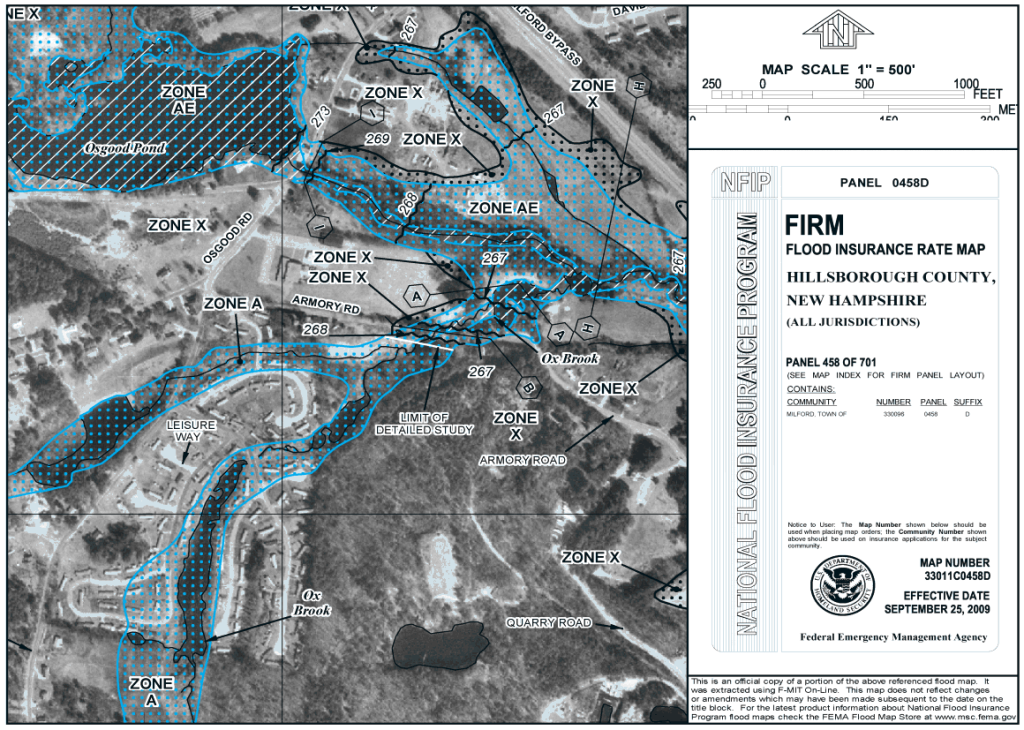

12302020 A Flood Insurance Rate Map FIRM or flood map is an official map on which FEMA has delineated Special Flood Hazard Areas SFHAs or areas at a high risk of flooding. 10182017 The type of flood zone you live in has a huge effect on the price of your flood insurance. Annual premium in High-Risk flood zone is 313175 This option will take properties that have had one flood loss as long as it has been more than five years and the payout was under 100000 on the claim.

Keep in mind that if you pay cash for a home no one can force you to ever purchase flood insurance it is purely your choice whether you do or not. The annual premium for. Lets start with crawlspaces above grade compared to subgrade.

Their coverage matches the NFIP. 852015 On the Flood Insurance Rate Map Zone X shaded refers to an area with moderate flooding risk while Zone X unshaded refers to an area with minimal flooding risk. Flood insurance rates vary from home to home based on a number of factors including the homes.

However premiums also account for usage factors. 500 C St SW Washington DC. 15 hours ago Zone X formerly Zone C low-risk zone.

Zone Shaded X formerly Zone B moderate-risk zone 02 annual chance flood Zone AO areas of shallow flooding. Your flood insurance rate will not change until the maps become. Their coverage matches the NFIP.

3282018 In the largest cities in Texas premium prices range from 479 to 1165 per year.

3 Fema S Map Modernization Program Elevation Data For Floodplain Mapping The National Academies Press

3 Fema S Map Modernization Program Elevation Data For Floodplain Mapping The National Academies Press

Flood Zones Insurance Ri Shoreline Change Special Area Management Plan

Department Of Engineering Flood Zones Flood Zone Definitions

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

Elevation Certificates Vbgov Com City Of Virginia Beach

Elevation Certificates Vbgov Com City Of Virginia Beach

Massachusetts Document Repository

Massachusetts Document Repository

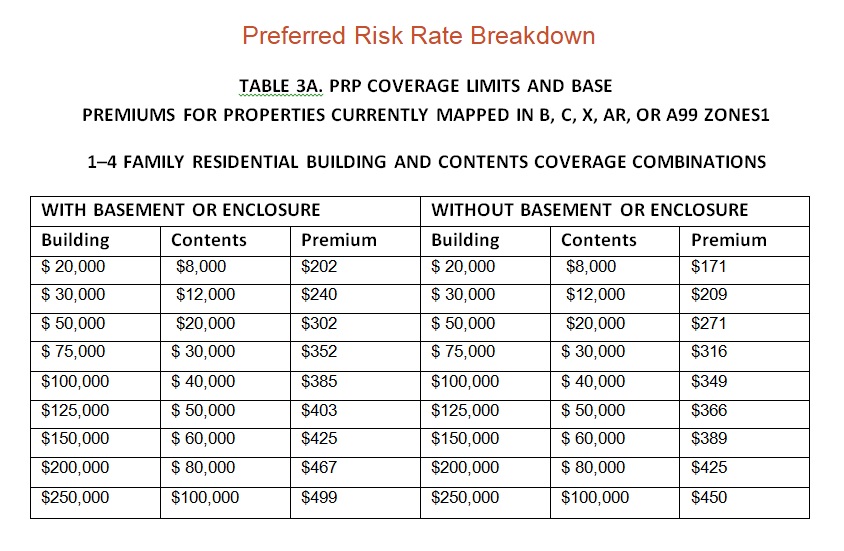

A Preferred Flood Insurance Policy Prp Should Be Homeowners 1st Preference Moore Resources Insurance

A Preferred Flood Insurance Policy Prp Should Be Homeowners 1st Preference Moore Resources Insurance

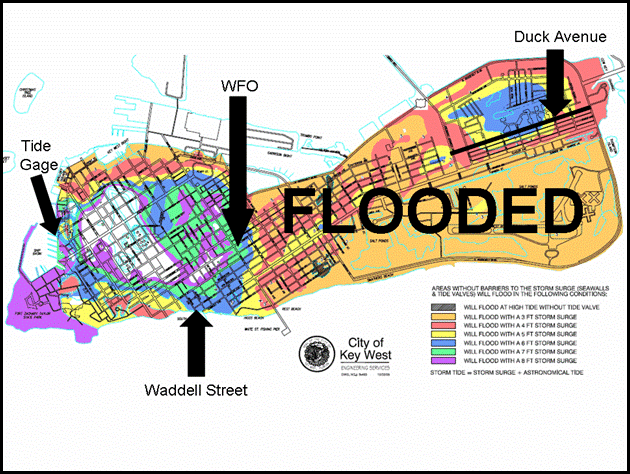

How To Read Flood Maps Key West Fl

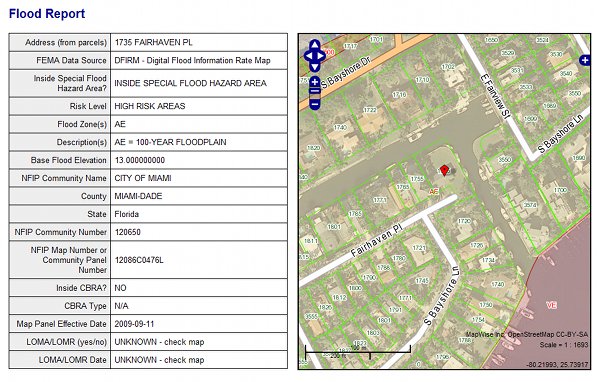

Florida Flood Zone Maps And Information

Florida Flood Zone Maps And Information

Understanding Fema Flood Maps And Limitations First Street Foundation

Understanding Fema Flood Maps And Limitations First Street Foundation

2 Nfip Procedures For Analyzing Flood Hazard And Calculating Insurance Rates Tying Flood Insurance To Flood Risk For Low Lying Structures In The Floodplain The National Academies Press

Climate Resiliency Frequently Asked Questions

Climate Resiliency Frequently Asked Questions

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

Understanding Zone Ae Flood Insurance Calculating Cost For Coverage

Florida Flood Insurance Cost And Coverage In 2020

Florida Flood Insurance Cost And Coverage In 2020

Is Your Flood Insurance Going Up Part Viii John Parce Real Estate Key West

Is Your Flood Insurance Going Up Part Viii John Parce Real Estate Key West

The Low Down On Flood Zone Designations For Charleston Myrtle Beach Real Estate Premier One

Post a Comment for "Flood Insurance Rate X"